The small-scale affidavits are usually used to avoid the probate process, which is usually costly and time-consuming- the small estate affidavit makes it possible for children or spouses to immediately take possession of property left behind the deceased without waiting for a lengthy probate process at the courts.

A small estate affidavit also referred to as the Affidavit for Collection of Personal Property, is a legal document containing a sworn statement permitting someone to legally claim the assets/estate of someone who died without leaving a Will.

The small estate affidavit is usually considered when the deceased leaves a small estate valued between $5,000 and $150,000. This, however, depends on the State’s policy on how and when the small estate affidavit can be used.

The person making a claim is usually required to submit a small estate affidavit to the Probate Court located in their State, country, or jurisdiction. After submitting, the petitioner must notify all creditors since they’re required to be paid first in case of any outstanding debts left behind by the deceased. The people inheriting the Estate are legally responsible for paying off any debts accrued that the deceased may have left.

Limitations of Small Estate Affidavit

Each Estate usually has its regulation on how and when the small estate affidavit can be used. These regulations are very important as they help determine the best process to distribute the Estate left behind. For example, small estate limits range from a high of $275,000 in Oregon to a low of $10,000 in Georgia, South Carolina, Vermont, and Hampshire.

These limits can also vary and be divided by what type of property is at issue in the State. For example, a state may allow for a Small Estate limit total of $100,000 – $50,000 of it is in real property, and the other $50,000 is in personal property.

In some states, properties such as motor vehicles cannot be transferred using a small estate affidavit. All states tend to limit the total value of assets, also referred to as maximum allowance. If the full value of all assets that are to be distributed is larger than the maximum value listed, then one cannot use a small estate affidavit.

Small Estate Affidavit VS Affidavit of Heirship

Like the small estate affidavit, an affidavit of heirship is used to distribute the assets left behind by the deceased when they die without leaving a Will behind.

The affidavit of heirship is used to declare the legal heir of a person who died without leaving a will- the affidavit makes it possible for the deceased’s assets to be transferred to the rightful heir. An Affidavit of Heirship’s sole purpose is to name the Estate’s rightful heir and acknowledge that the person died without leaving behind a Last Will. The Affidavit of Heirship is usually filed with the court to establish the rightful heir to a given estate.

Similarly, the small estate affidavit is used to distribute the estate of the deceased when they die without leaving a will, and their Estate’s value in question is below the small estate limits set forth by their State. Using a small estate affidavit is faster than the probate process and allows the beneficiaries to access the properties or Estate much quicker and with less paperwork.

What is Probate?

When someone leaves behind a Will outlining how their Estate is to be distributed, the person tasked with executing the Will is responsible for filing it and initiating the probate process. In most cases, the executor is usually the family’s lawyer, financial advisor, or a lawyer appointed by the court.

The probate is a court-supervised process of validating a Will or Testament if the deceased left one. The process includes locating and determining the worth of the deceased assets, paying off any bills, debts, and taxes, and allocating what is left of their Estate to the rightful persons.

The probate process begins by analyzing whether or not the deceased provided a legal and authentic Will outlining how their Estate shall be distributed. Consequently, when you die without leaving a Will, the legislation becomes the ones to determine how your Estate shall be distributed. The court appoints a lawyer who acts on behalf of the deceased who looks at the best possible way to distribute the Estate.

Are Small Estates the Same in All States?

Small estates usually vary depending on the State’s definition of the small Estate. All states have a threshold defining what is to be considered “Small Estate.” To properly streamline the probate procedure and reduce the costs for estates that don’t exceed the threshold, each State has its policy for processing a “small estate” with less court involvement and paperwork.

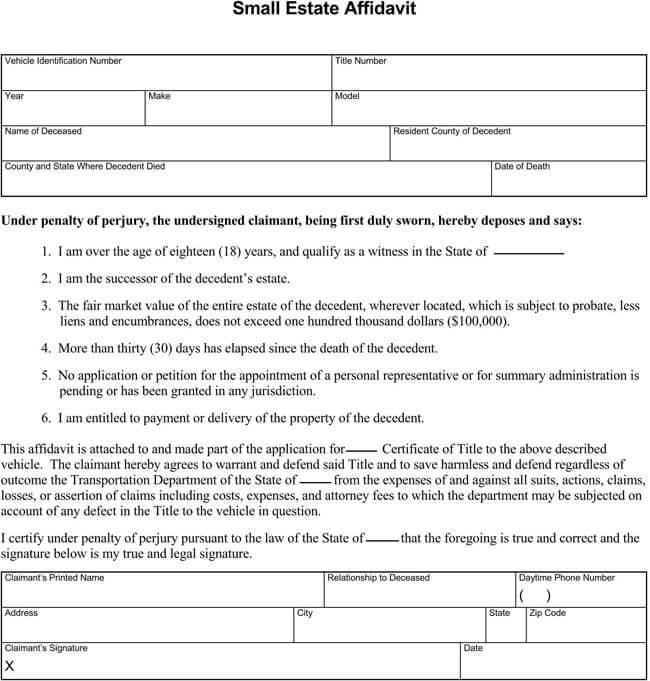

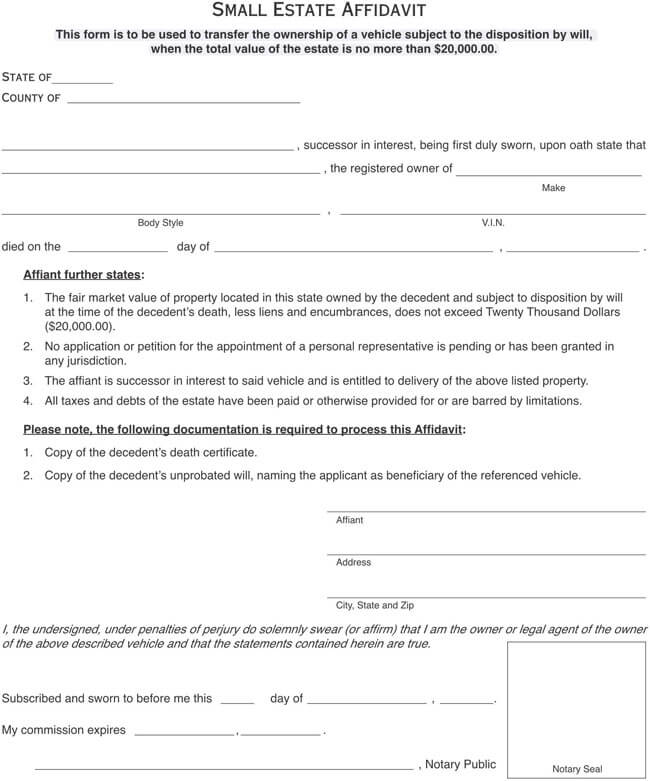

How Do You Fill Out a Small Estate Affidavit?

Filling out a Small Estate Affidavit is not hard; however, you have to be absolutely keen as a simple mistake can lead to dire consequences.

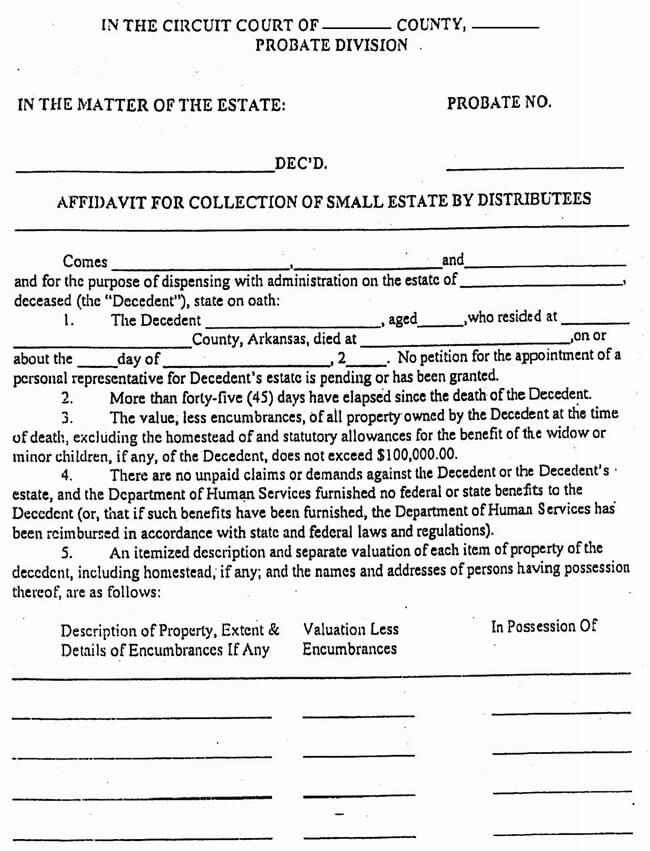

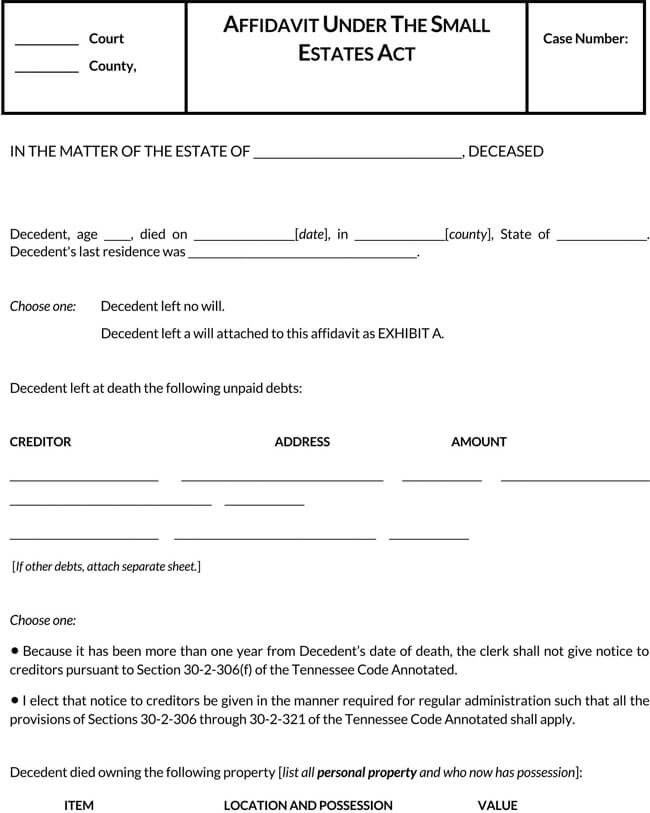

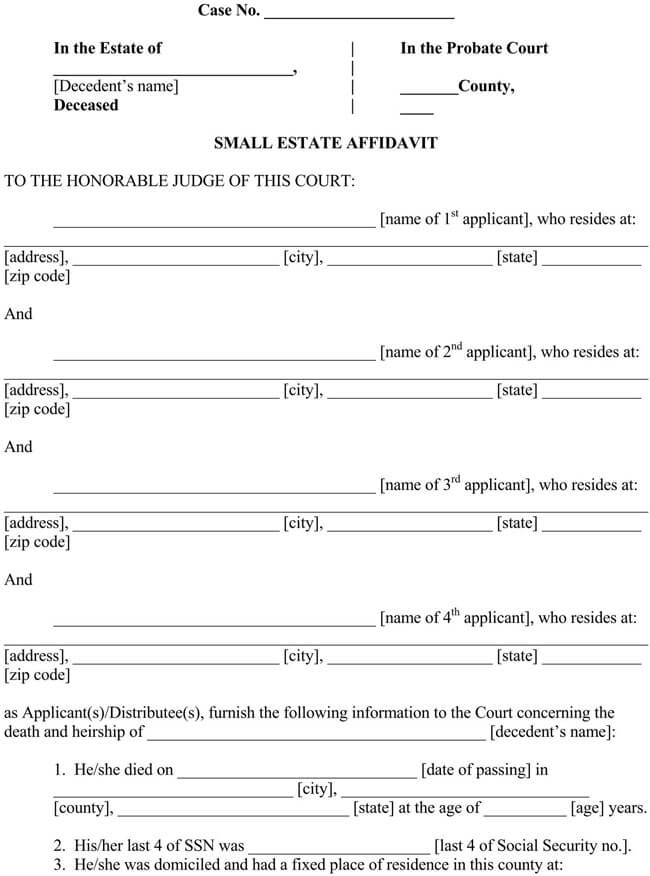

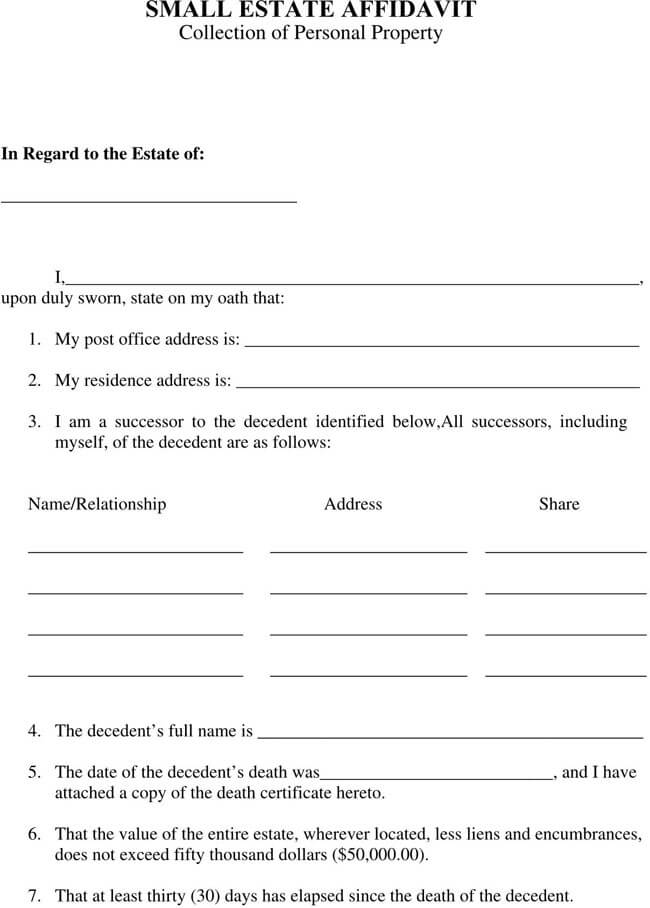

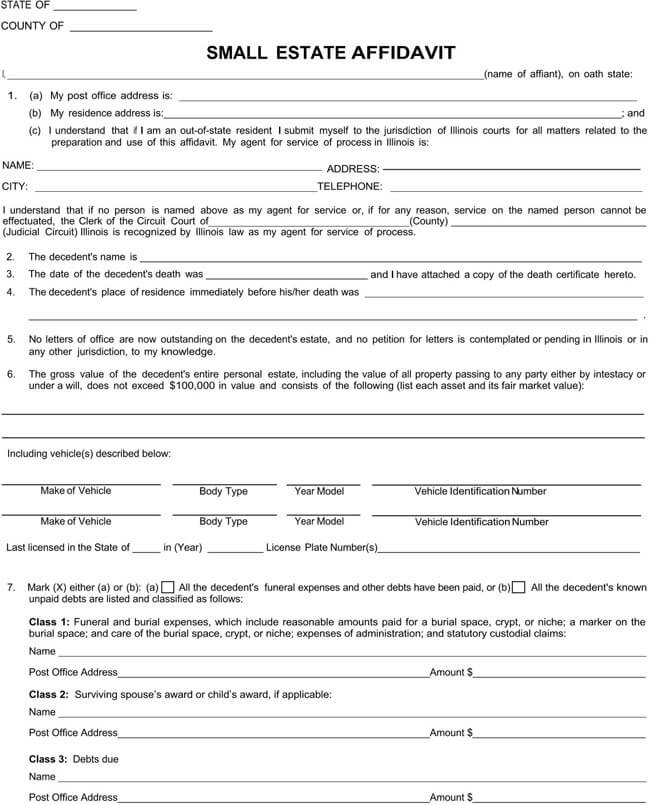

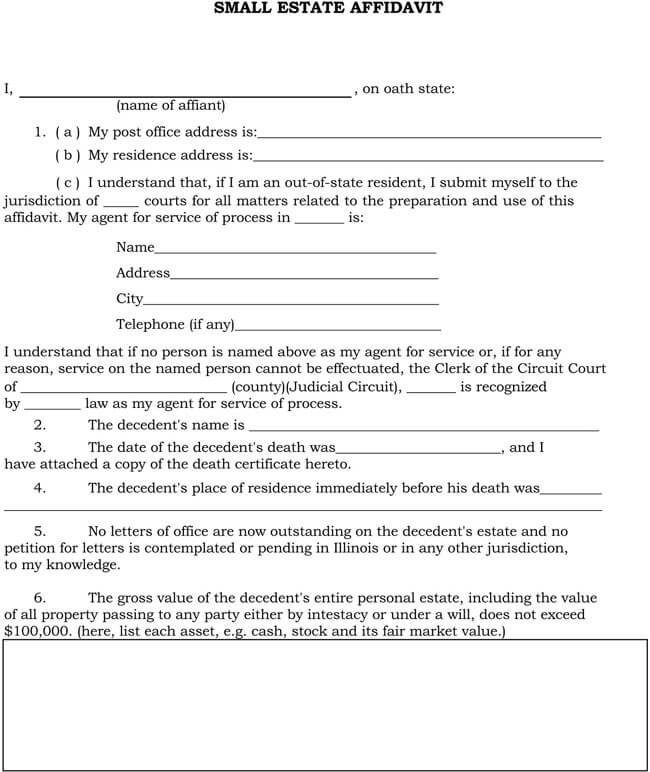

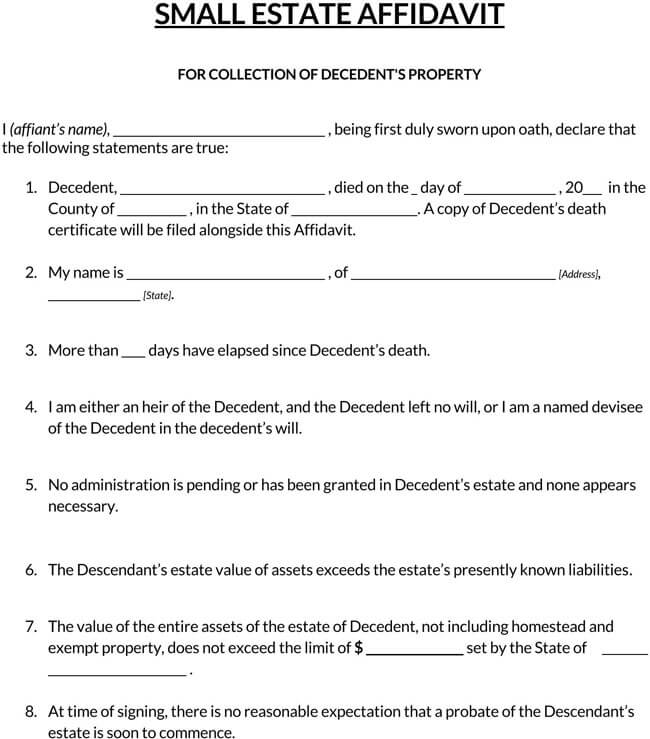

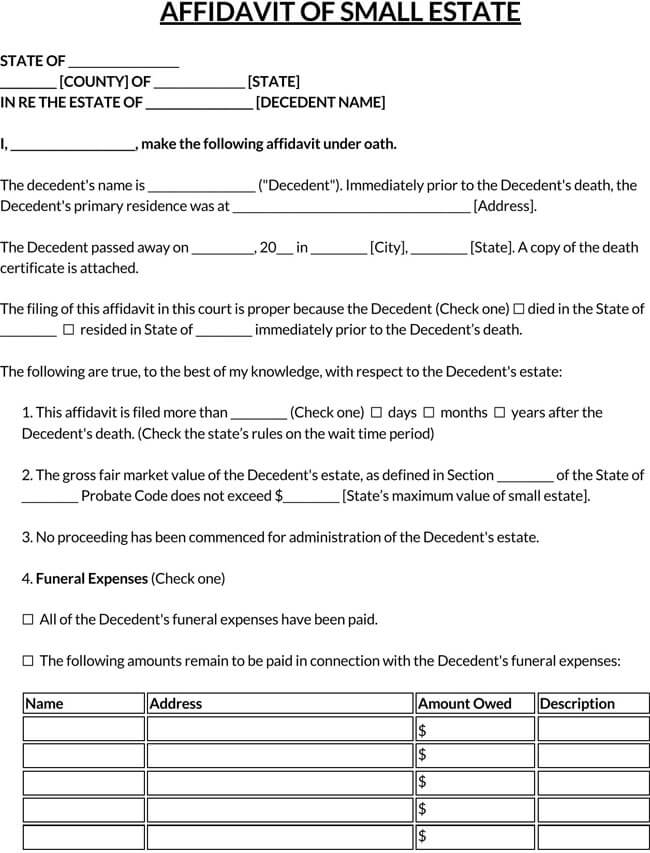

The following steps should be followed to fill out a small estate affidavit:

Add basic information

Confirm the date when the deceased passed away. Make sure to verify the data before including it in the affidavit. Also include the city and state where they passed away. You can obtain this information on the official death certificate issued by the Bureau of Vital Statistics or any other equivalent entity.

Intestate or testate death

After you have obtained all the basic information about the deceased, the next step is to attest whether they died “intestate,” i.e., the deceased left a Will, which defines how their Estate shall be distributed, or “testate,” i.e., the deceased did not leave a Will – the probate court has to determine the distribution of their property to their family, heirs or beneficiaries according to a priority statute. This stage is very important, and one should check with their state laws as some states permit the use of this procedure only if the deceased left a Will, while others allow both. In the event that there is a Will, make sure that you have a copy of it to present as proof to be used in the distribution of the Estate.

Add funeral expenses or additional claims

The next thing to do when filling out the small estate affidavit form is to indicate any outstanding funeral expenses. If the funeral expenses have not yet been paid in full, make sure to compile all the items and their corresponding amounts and description.

Other than the funeral expenses, also provide any additional claims that there are against the Estate. If the deceased left any outstanding debts, they should be settled by the Estate’s assets and the remaining distributed to the rightful persons.

List surviving heirs

After you have listed all the debts accrued by the deceased and have determined what will be left after they’ve been paid, the next thing is to include a list of names of all the surviving heirs, if any. They may include any close relatives, spouses, children that could rightfully claim ownership of the deceased Estate.

Personal property distribution

List down the deceased’s personal property being distributed, if any. All states have their own definition of what’s to be considered as personal property; some exclude real property while others don’t. The total value of the personal properties must be included in the affidavit. Personal property usually includes anything other than real property, e.g., general possessions like jewelry and clothing or vehicles.

Other than the personal property, you also have to list down any real property left behind by the deceased, if any. Real property may include things such as the house, land, or anything that would require a title or deed to be transferred.

Legal Considerations

All states have their definition of what’s to be considered “Small Estate.” In most states, however, the use of a small estate affidavit is only permitted if the deceased person had less than $100,00 in probate assets. Even so, there are still other requirements that must be satisfied to warrant the use of the small estate affidavit.

Some of the requirements are:

- You must be the legal “Successor,” as defined in most states’ small estate affidavit statute. You are the legal successor if; you are entitled to the Estate in question under the Will of the deceased or under your state laws of intestate succession in the event that there is no Will. Consequently, you may also be considered the automatic successor in most states if you are the surviving spouse.

- Some states require that the deceased must have been a resident of the State in question at the time of death.

- Others require that no petition or application of an estate administrator or personal representative is pending or has been approved in any jurisdiction.

How is Small Estate Property Distributed

Customarily, the small estate affidavit is used when the deceased left no Will. Some states, however, allow its use in conjunction with a Will depending on set legal requirements. It is recommended that before using a small estate affidavit, you consult with an attorney in the corresponding State where the final estate matters shall be resolved.

To determine the mode of distribution of the deceased Estate, the process begins by first calculating their Net Worth. Depending on their State’s definition of what is to be considered “Small Estate,” the distribution process can then begin.

If the Net Worth falls under the small estate category, the family and anyone owed by the deceased are notified and given time to present any queries or grievances that they may have, usually between 15-60 days. During this time, the heirs/beneficiaries are required to collect and present documents that support their claims in the deceased Estate.

The family is afforded this time to contact the Bureau of Vital Statistics or any other equivalent entity to obtain the deceased death certificate and the title to all the properties they owned.

After all, the documents have been gathered and the waiting period has lapsed, the lawyer in charge of the probate process then proceeds to complete the Small Estate Affidavit. During the completion, all the properties of the deceased should be included in an itemized list. The form is then presented to the heirs/beneficiaries to sign in front of the seen public, witnesses, or both.

After the small estate affidavit has been completed, the heirs to the Estate are notified before the form is filed- all the heirs considered to be entitled to the Estate must be told of the small estate filing.

After all the documents have been collected, the affidavit is then filled with the probate court clerk’s office. The clerk will take 5 to 15 days to process, accept or reject the filing. Once received, the property and assets will be transferred, and the process shall have been completed.

Download Free Small Estate Affidavit Forms

When someone dies, and you are looking to distribute the Estate that they left behind, the process can be tiresome when you don’t have the right form to use. To make your work much easier, you can download our free small estate affidavit form to use when in such situations. Download today and get started!

Frequently Asked Questions

Does a small estate affidavit have to be notarized?

Most states usually require that the Small Estate Affidavit be notarized for it to be considered valid. However, even if it is not required in your State, you should still have it notarized since the financial institutions in charge of releasing the assets left behind by the deceased may require notarized proof that you have the right to claim the assets.

How much does it cost to file an affidavit of heirship?

The cost of filing an affidavit usually vary from State to State. It is recommended that you contact your attorney or County Clerk in the State where the Estate is to be distributed to find out how much their filing fees are.

Who signs a Small Estate Affidavit?

A small estate affidavit is signed by the person named executor of the Estate. This could be the spouse, children, or guardian of the minor, parents of the deceased if the deceased is a child without a spouse.

Conclusion

A Testament or Last Will is a legal document that lets you decide what happened to your Estate after you pass away. It makes it easy for your Estate to be divided or given to the right heir/beneficiary. However, when you die without leaving behind a Will, the legislation becomes the ones to determine how your assets shall be distributed- in which case, depending on the size of your Estate, may either be a long, expensive legal process or a simple one which involves the use of a Small Estate Affidavit if the Net Worth of the Estate is in line with the threshold set by their respective State.