Budgeting is the most significant financial habit that any organization must adopt. Some organizations begin their operations with a wave of enthusiasm and optimism, but without a clearly defined budget, they find it hard to create a successful action plan. When running a nonprofit organization, it is common for one to get bogged down with their daily duties and responsibilities and miss the bigger picture. Successful nonprofit organizations usually allocate time to create and manage their budgets, preview their business plans, and continuously monitor their financial situations and business performance. Proper budgeting is the foundation of any organizations’ success. It helps in both the allocation and management of the organizations’ finances.

What is Budgeting for a Nonprofit?

A budget is a guide that helps nonprofit organizations plan for their future, including their assets and financial health. A budget is a financial document outlining how an organization is planning to spend its money. The budget can be considered as a reflection of what an organization is looking to accomplish over a set period of time. The budget is often reviewed to check whether it is playing out as expected over the budgeted period and can be amended to meet the set objectives.

Operating Budget VS Capital Budget

A budget outlines the financial plan of an organization. The budget is usually broken down into two: the operating budget and the capital budget. The operating budget focuses on the day-to-day activities of the organization and often covers a one-year period during which it is continuously reviewed, and any deviations for the expected revenues and expenses are measured for any changes that may affect the annual operating profit. Capital budgets, on the other hand, is usually long-term and focuses on the organization’s internal investment strategy. The capital budgets may also be updated annually to go with the changing trends in the organization’s finances. Normally, capital budgets are made to last for over five to ten years.

Importance of Budgeting for a Nonprofit

Budgeting is key to any organization’s success. Why? Here is why any nonprofit organization should make a budget for their daily operations:

- Budgeting helps in the estimation of revenues, planning of expenditures, and restricts any unnecessary spending that has not been planned for.

- Budgeting ensures that the finances are properly allocated to things that support the organization’s strategic vision.

- A carefully crafted and communicated budget helps all the members of the organization understand its priorities.

- The budget creation process provides a great opportunity to involve the staff, making it easy for them to share and understand its objectives.

- Proper budgeting helps the organization to operate on what they have and not make any assumptions. With proper budgeting, the organization can make a plan based on the amount of cash that they have and not operate on assumptions.

- Budgeting helps the organization to prioritize its cash flows. Who are their donors? When will they receive the next donations? What should they do to remain afloat? What should the organization do to increase its funding? Proper budgeting helps the organization put more focus on such questions.

- Budgeting helps the organization track and monitor its expenses throughout the year. With a great budget in place, the organization is able to keep tabs on its expenses and make the necessary changes to ensure that they meet its objectives.

Budgeting Checklist (How to Start)

Nonprofit budgeting is not always easy, for any nonprofit organization to meet its objectives, the approach that they choose when budgeting has to reflect on its uniqueness. Even so, while one organizations’ success recipe may differ slightly, you will still have to check many of the same budgeting boxes that are reflected below:

Review previous performance and budget:

If you have your previous budgets and performance reviews, make sure that you closely examine them and compare them to the actual performance. Reviewing your previous performance and budgets will give you a greater source of knowledge from which to base your assumptions and budget projections.

NOTE: Your review of previous performance and budget is just a measure of what you could possibly achieve, and it is not always the best measure of future returns.

Assign decision-making authority:

Depending on your organization’s policy and size, you may have several people working on the budget. Even though it is always important to hear different opinions when making a budget, at the end of the day, there must be someone in charge to make the tough decisions.

Define your risk profile:

The risk profile is the willingness of your organization to take a certain risk. Make sure that you make this clear from the get-go so that everyone is in line with how much uncertainty the organization is willing to tolerate.

Develop a schedule:

Most organizations usually require a new budget every fiscal year. If you a new organization and this is the first budget that you are making, give all the members enough time to prepare the budget. This will allow them to meet and discuss as well as a factor in all the items that they are looking to include in the budget. Once

they’ve gained enough experience, you may find that they need more or less time to prepare the budget.

Define the organization’s mission and vision:

This is very important, especially for nonprofit organizations. Every dollar that they spend, borrow, save, or raise should be geared towards serving the organization’s mission and vision. To make sure that the budget is in line with the mission and vision statements, tie your goals to the hard numbers in the budget.

Review draft budget:

Develop a draft expense and income budget. After developing the budget, review it to make sure that all the items are budgeted for and that no item is left out. Also, make sure that the calculations are right and that the figures included are the actual figures.

Approve the budget:

After reviewing the budget and making sure that everything is as it should be, it is now time for you to approve the budget. You can have the chair sign the budget together with the person in charge of the finances.

Document the budget decisions:

It is important that you document the decisions you make as they will help you when making your future budgets. For instance, you can document why you chose a particular item or approach over the other. Such decisions, if well documented, can help when reviewing the budget for changes and also when making future budgets that involve the same items or processes.

Implement the budget:

After approving the budget, it is now time for you to put into action what you have budgeted for. If you are a new nonprofit organization, you will find that there are areas that you need to adjust to fit your objectives. Review and document the changes as you go to help you plan better next time when making the budget.

Other Tips to Follow

Here are some tips to help you out when making your nonprofit budget:

- Document your assumptions and calculations: when making your budget, it is important that you document all the assumptions and all your calculations. For instance, if you are assuming that the price of an item that you frequently use will be $10, write it down. Otherwise, you may get confused in the process of trying to remember what that item was.

- Use real figures: Don’t base your budget on assumptions. Figure out the prices of all the items that you are budgeting for first before including them in the budget.

- Double-check your calculations: No one is perfect! Always counter check your calculations to make sure that you have not missed anything. It is common for people to leave out some zeros or miss a number. Go through your calculations several times and make sure that the total amount you get is the same.

- Separate your calculations from equipment, capital, and any special projects: when making the budget, create a separate budget for the capital needs, the equipment, and any special projects that the organization will be running. The budget should only include the revenue and expenses that are essential for the organization’s processes.

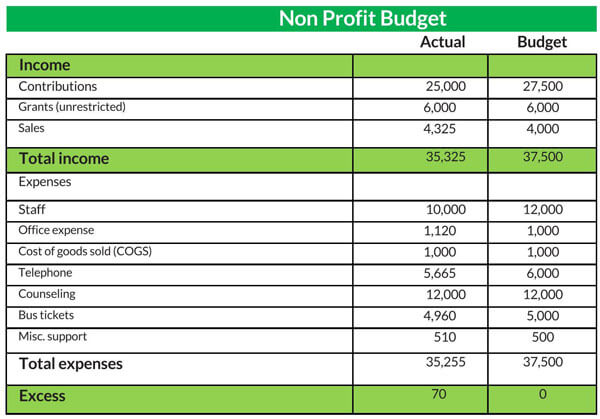

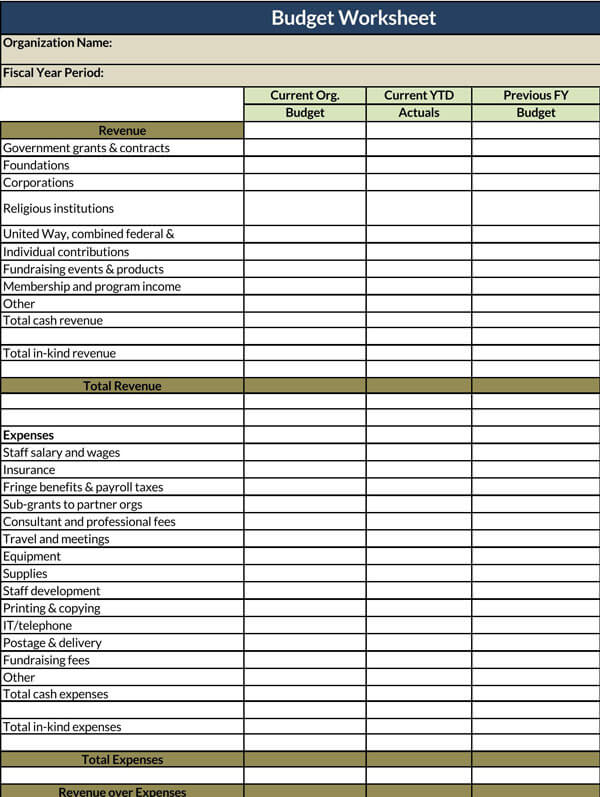

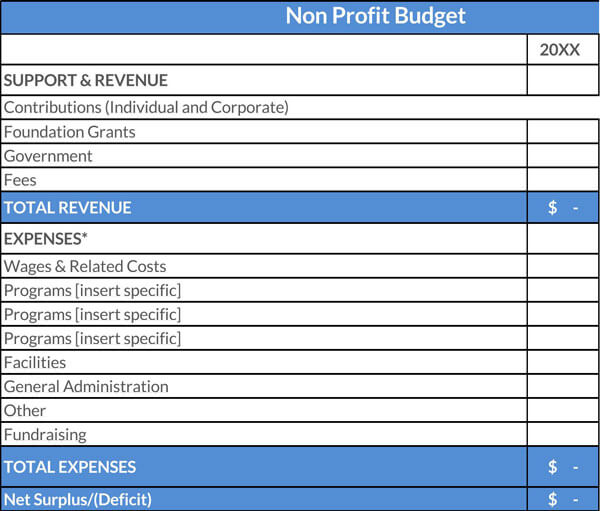

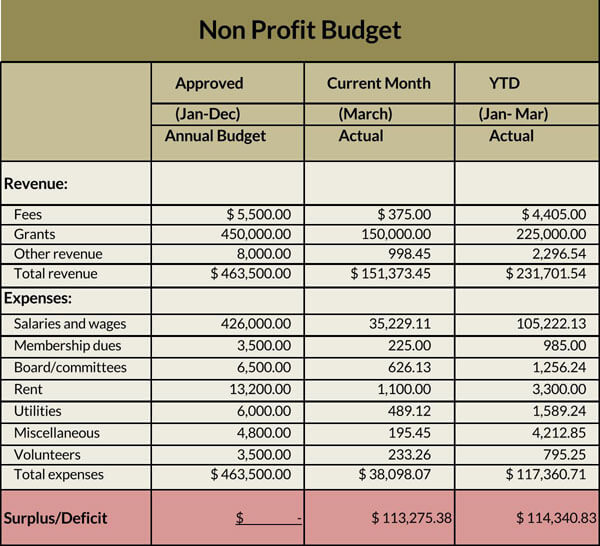

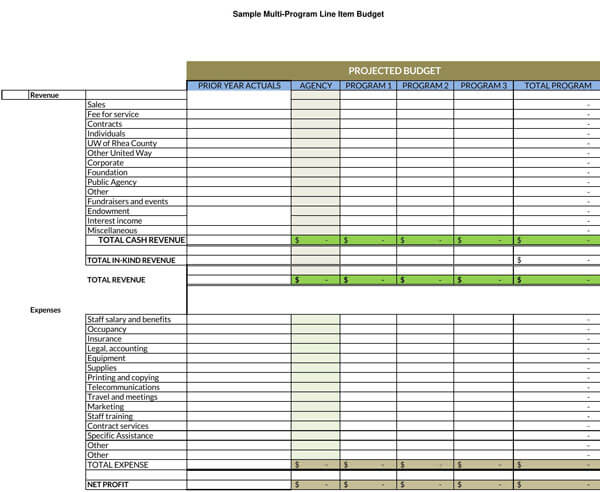

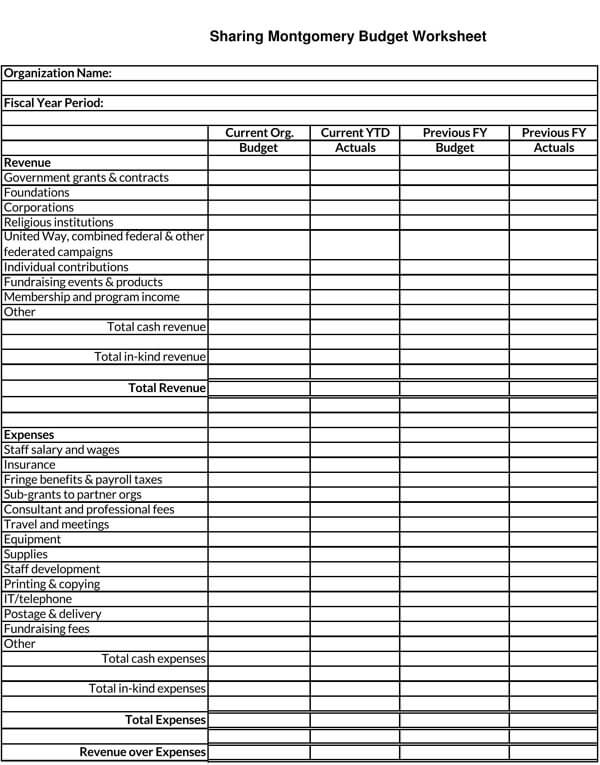

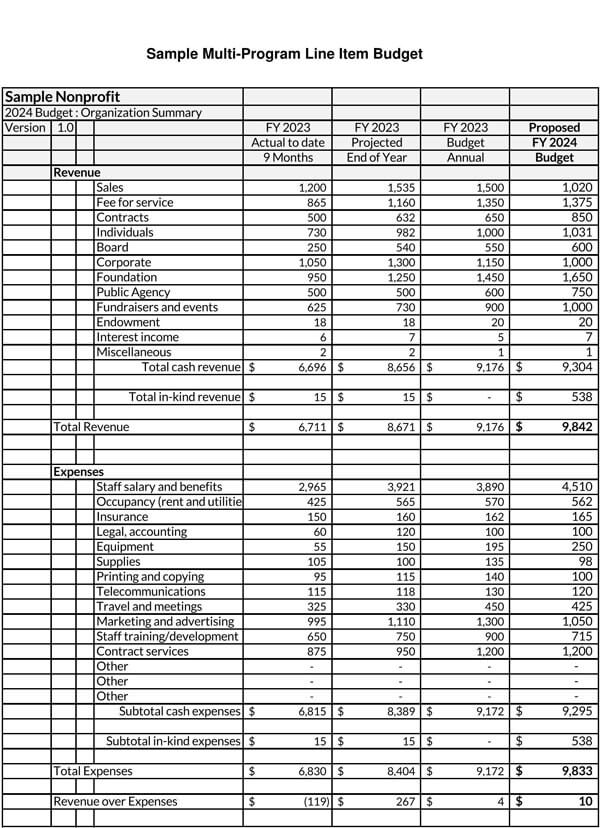

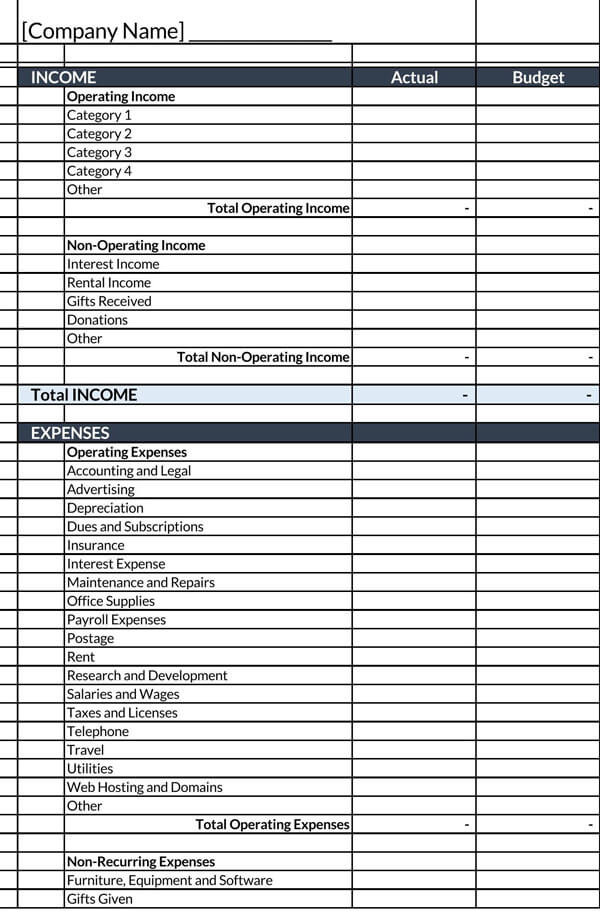

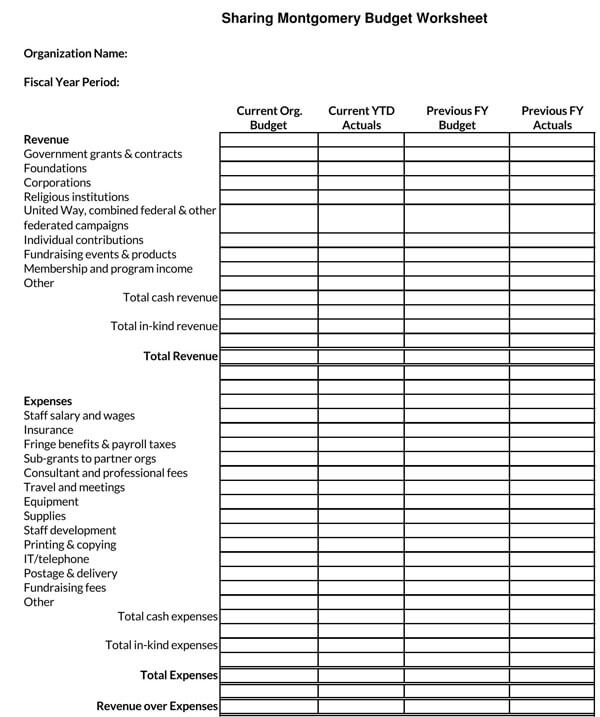

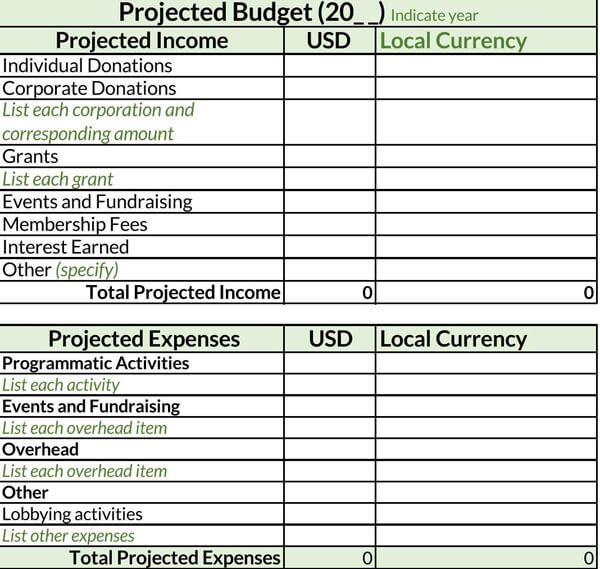

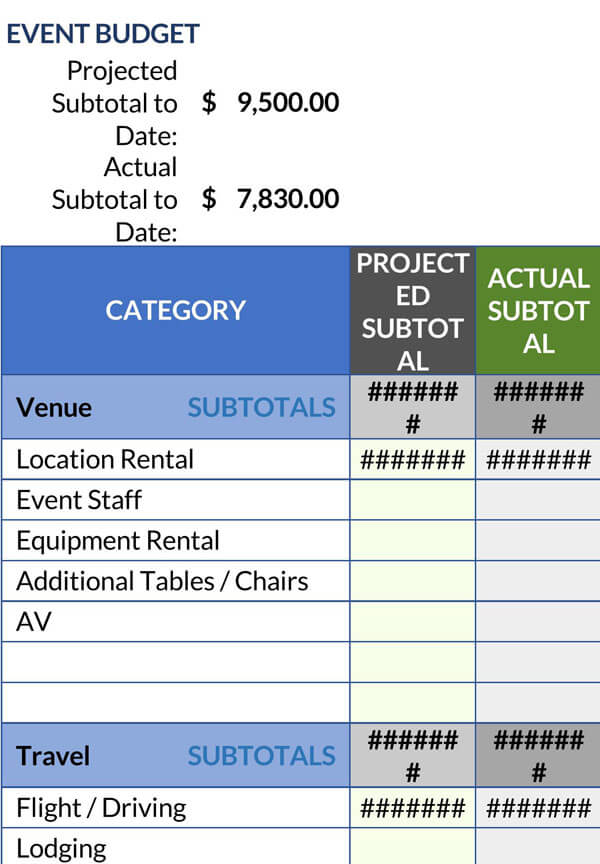

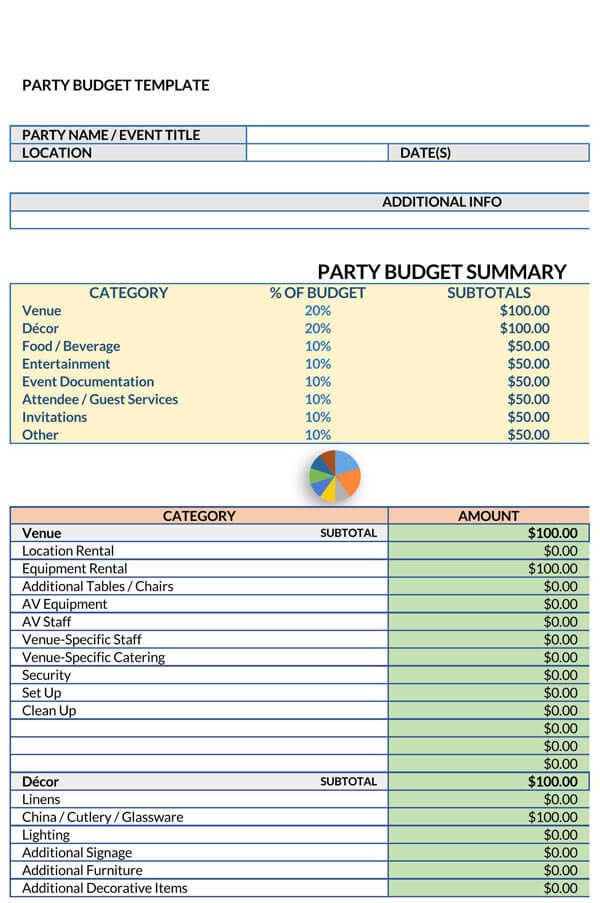

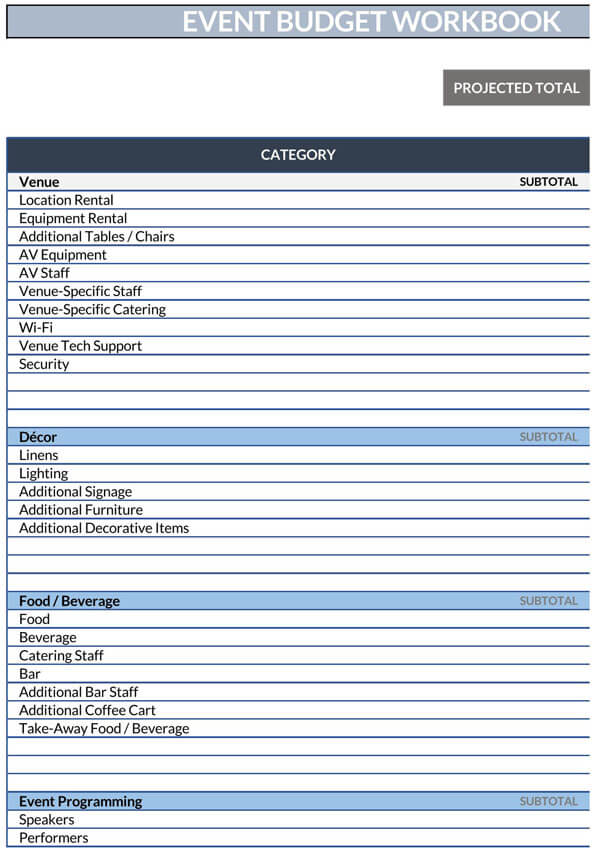

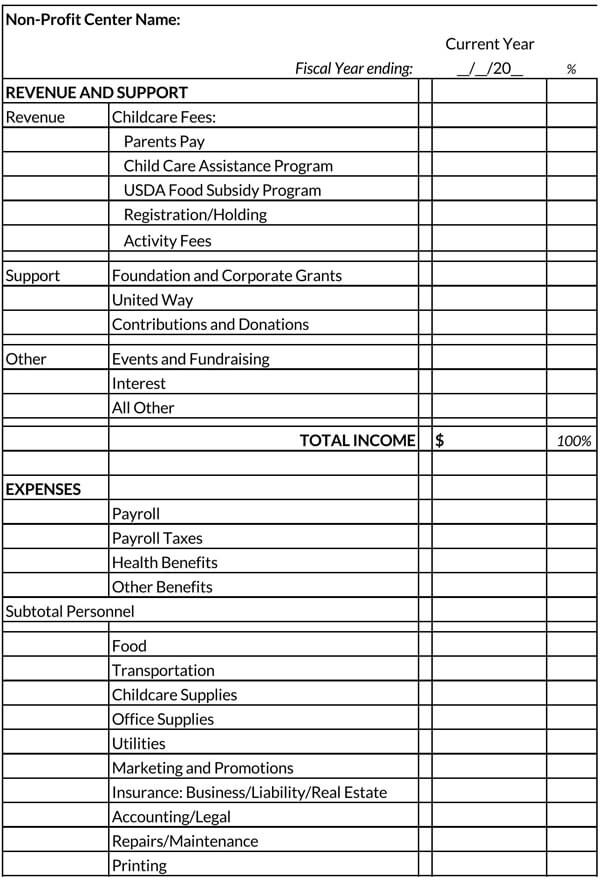

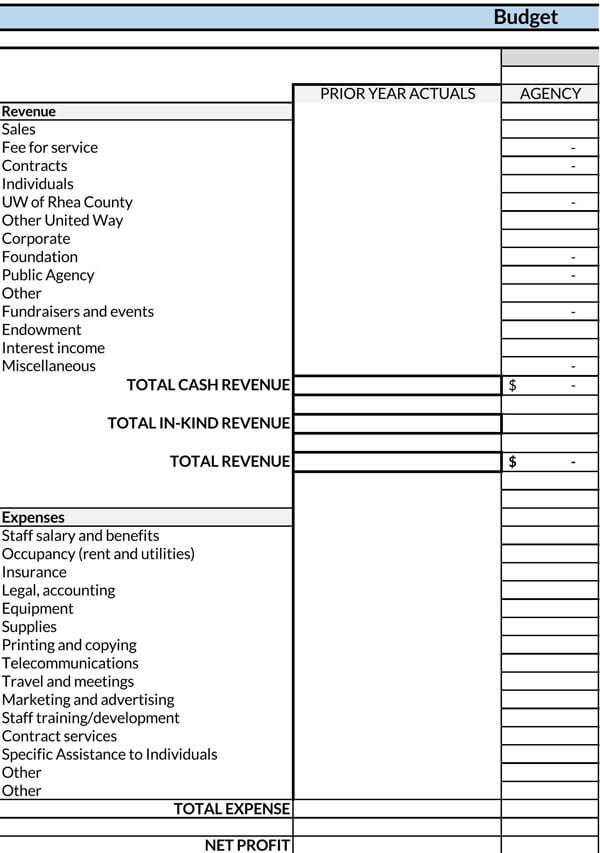

Free Nonprofit Budget Templates

If you are planning on creating a comprehensive budget for your nonprofit organization and are looking for templates to guide you, check out our website for an entire collection of templates and download one to get started with your budget.

How do you Apply a Budget Clearly?

To avoid a future financial crisis after making your budget, here are some basics that you should consider when applying your budget:

Set realistic goals: Be realistic with what you want to achieve. Also, set realistic timelines for when you would like to achieve those goals.

Start early: Make your budget as early as you can and improve on it as you go. You don’t want to make rush financial decisions as this may be very costly.

Identify your income and expenses: when making your budget, ensure that you first identify all your income and expenses and make sure that you spend only what you can afford.

Allocate some cash for extra expenses: Don’t make your budget too rigid. If you are looking to buy some items, make sure to factor in all the processes involved such as transportation and anticipate any price fluctuations by allocating some extra cash.

Track your numbers: Track and record all the expenses and revenues over the budget period. Such details will come in handy when you are preparing your next budget.

Bottom Line

The budget is a very crucial tool for any nonprofit organization as it helps in its planning and finance management. Make sure to allocate enough time when coming up with a budget, especially if it is your first time doing so to ensure that you don’t miss out on any important elements that are vital to the organization.

When making a budget for your nonprofit organization, focus on its vision and mission statements, and make sure that the budget reflects on that. Making the right assumptions and budget estimations are vital to productive nonprofit budgeting. After all, a great budget that is properly implemented will serve as a road map to its success.