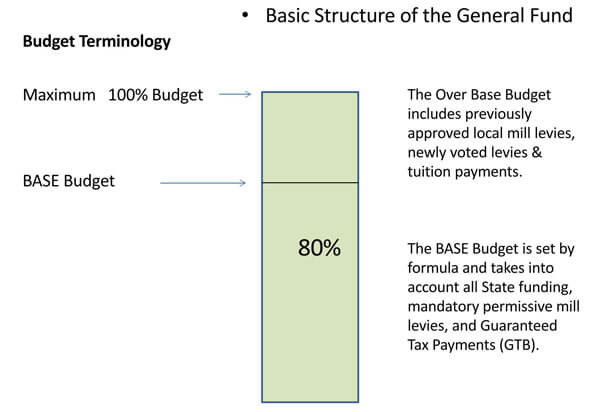

A school budget is an itemized summary of a school’s intended expenditure. It is used to show the amount of money a school operates and how it is spent within the school. A budget should be prepared annually based on the school’s calendar. One differentiating characteristic of a school budget from other organizations’ is that 80% of the budget is allocated to personnel, leaving just 20% to cater to all other needs, which can be challenging to prioritize in such a situation. Even more, taxing is the fact that this expenditure is government-controlled, together with other governing bodies.

Why Do Schools Need a Budget?

A school can benefit from a school budget in different ways. The most obvious one is that a school can track and control its expenses by ensuring funds are spent where it is needed and not misused through a budget. When a budget is prepared by every year, management can use past budgets to forecast expenditures. This, in turn, helps the school strategize on ways they can improve the quality of services (education) they offer. A well-written budget will help the school understand areas they should prioritize in the next year.

A budget in the long-term will help you to carry out the following analysis process when drafting a strategic plan in the future;

- Formal and informal audits

- To determine variations brought about by an increase in enrollment

- Monitoring performance

- To determine the school’s effectiveness in the implementation

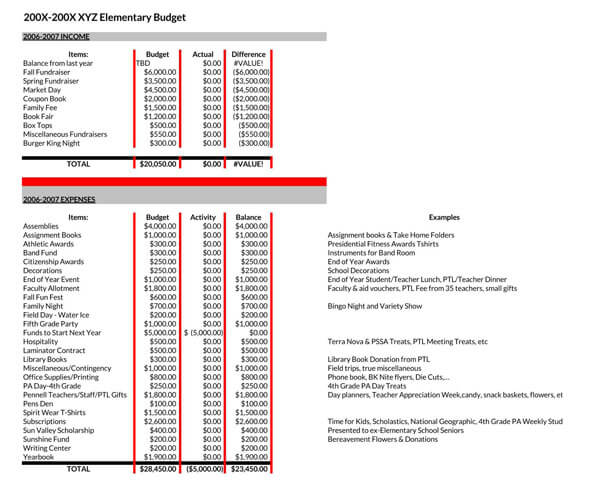

A school budget can be used to determine the difference in expenses brought by instructional versus non-instructional costs and budgeted versus actual expenditures so as to set targets during fundraising.

Guidelines: Before Budgeting

In case you find yourself having been tasked to draft a school budget for the first, there are several aspects of a budget you will have to put into consideration. You should not worry as there is a first time for everything.

The guidelines include:

The budget should reflect an improvement plan

When preparing your school’s budget, you should have its improvement plan in mind. Despite your school’s past spending habits, you should not limit the budget to the areas and amount used in the past. Try to imagine money is not a limiting factor and identify areas of improvement, which could be either by inclusion or exclusion. You can use a five-year improvement plan- taking two years in retrospect, the present year, and the next two years. Before writing the school’s budget, you should find information on the pupil population, school academic performance, staffing requirements, and other relevant sectors.

Understand basic principles

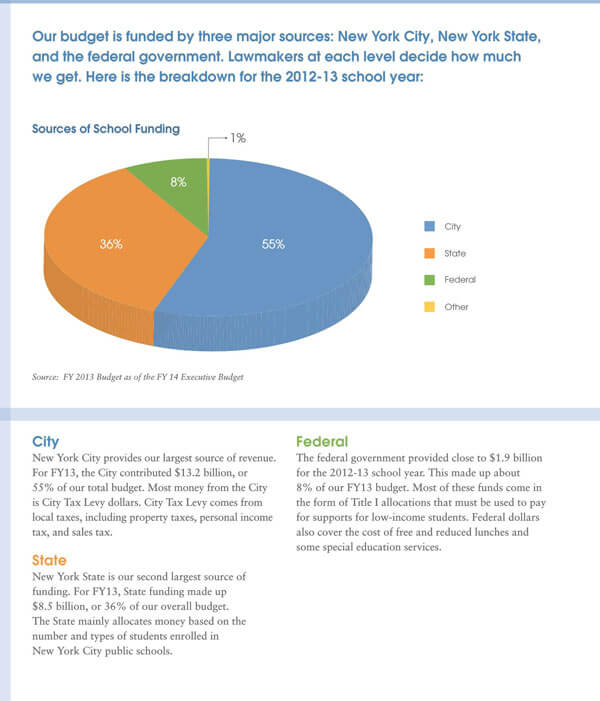

Ensure that you are familiar with the basic principles that influence the amount allocated to the schools and the vulnerability of the school’s budget to changes. One of the essential things to understand is the sources of the school’s finances.

These sources include;

Delegated funding: This is money provided by the government as education is considered a key area of investment for development in a country. It is as a grant, and there are no conditions of receivership.

Devolved funding: Also known as Devolved Formula Capital (DFC) grant is direct funding given to an educational establishment for its priority capital needs of its facilities and grounds and infrastructure such as ICT.

Capital funding: This is funding given to a school for the acquisition and improvement of long-term assets such as construction, acquisition, and renewal of buildings.

Revenue funding: This is money given for usage within a year. Uses include but are not constrained to salaries, lighting, water, reagents, etc.

For example, in a school where 60% of the pupils are eligible for free school meals, the budget funding proportions could be as follows; the most significant percentage of funding, which is calculated using a national formula that is based on the characteristics of the pupils in that school in that school, will be from the Dedicated School Grant (DSG). The second-biggest percentage of funding will be from pupil premium to cater to the 60% of pupils that need to be looked after. Additional funding could be from Devolved formula capital funding for priority capital needs and then other sources

Have value for money

When allocating money, ensure that the set amounts are able to get you the best quality products for the lowest price, improve results and the overall aspects of the school. The several ways you can use to determine this, one being through benchmarking in neighboring schools and learning how they spend their finances on things like stationery, building maintenances, catering, security, etc. This can give estimates of prices expected within your locality.

Another way is to carry out your own research from suppliers and determining the lowest prices available and from which supplier. You can also look into available means of acquiring products, such as buying in bulk or leasing. However, you should be keen on the risks involved with such means. An analysis of the VFM offered by past expenditures can be used as a guide for future spending.

Demonstrate VFMs confidently

When breaking down the school budget, present in an easy-to-understand format and explain where an explanation is needed; where there are shortcomings in the budget, do not shy from giving recommendations such as simpler and affordable alternative ways of achieving the same results. Point out areas where the highest VFM was attained. This can be done by comparing with showing how neighboring schools spent more on the same or showing the percentage increase of results that emanated from allocating that money.

Where the school has managed to save, give the governors areas you believe the money would be best utilized in. If you identify trends with the expenditures, discuss them and how they can be used to forecast future events and how it influences the school’s education performance.

Train teachers on school finances

Teachers, other than teaching, are responsible for some of the activities within a school, such as organizing trips, science fairs, athletic competitions, and such. These activities cost money and should be included in the budget. It is advisable to engage them from the get-go by holding a short Q & A meeting and getting their plans for the current year. They help provide estimates of the costs of undertaking these activities. This also demonstrates financial transparency within the school and increases accountability when handling money handed to them.

Stages to an Effective School Budget

It is safe to imply that you want your budget to be as effective as possible and professionally done at the end of the day.

The stages to school budget are as follow:

Create a timeline for the process

There are various tasks involved when developing a budget. They include research, calculations, analysis, and review. These tasks can be time-consuming; therefore, it is important to determine the time each takes to complete, and you can then plan how long the process is supposed to take. This helps you determine how frequently you can carry out your budgeting, whether monthly, quarterly or after a given period.

Estimate the annual revenue

Kindly ensure you have an estimate of the annual revenue a school receives. This is done by determining the amount of financial inflow that a school has. It includes all grants, funding, and profit from any school’s investments, e.g., a school canteen.

Gather stakeholders for funding

A school can have stakeholders from different sectors such as organizations, churches, government, and many more. They are often parties with financial capabilities and chip in when needed. They can be reached out and notified of the school’s plans and the costs associated with the same, and they would be willing to contribute.

Look up your available resources

After all, contributions have been made, find out the amount of money available. Once you are aware of the resources available, you can now determine which sectors require what amount of money. You can invite coordinators and cluster leaders to make their financial requirements for that year. Cluster leaders and coordinators can be defined as those in charge of various school programs as well as external stakeholders. By providing this platform, all the stakeholders can be involved in developing the yearly school development plan.

Submit final proposals to the board

Once all allocations have been made, the board would like to see your proposals. Since the proposals are made from an individual’s perception, the board can suggest you add, remove or alter some of the proposals for improvement.

Approval of school council

This is the final stage of budgeting. Once you have included the board’s suggestions, the budget is submitted for approval to the budgeting committee. The school council gives the go-ahead on the expenditures highlighted in the budget.

The following are considerations a school council should take into account before approving a budget;

- Whether budgeting was a collaborative process

- Whether the school has enough money to cater for all the budget

- The budget must be reflective of the school’s policies and priorities

- Does the budget meet the legislative requirements?

Steps Proposed by Financial Advisors

Schools usually operate under a tight budget, and proper budgeting becomes a necessity by default. Financial advisors help to prioritize a school’s financial needs and optimize the results based on the size of the budget awarded to them.

Steps taken by financial advisors are:

Understand the school’s investment needs

A financial advisor has the expertise to know the best way to carry out activities such as collecting data, research, reviewing previous budgets, and forming a team where necessary. Therefore taking their help in the process can and would prove to be very beneficial for the development of the school budget.

Highlight the objectives

There are main objectives that every school budget is prepared to meet. Therefore, the elements of your budget should be working towards achieving these objectives. A financial advisor advises on the best course of action towards this. It is also imperative to certify that your budget meets the following criteria of a good budget; it must be balanced (revenue equals expenses), must meet applicable legal requirements (federal, state, and locals), and finally must provide a basis for evaluation in terms of the school’s services, expenses and accomplishments a task that a financial advisor has been trained to carry out.

Track your school spending

It is important to track where most of your school’s expenses go, and you can do so by reviewing existing budgets. A financial advisor’s suggestion can be in identifying the percentage allocated to salaries and benefits, operation and maintenance, materials and supplies, and miscellaneous. This way, you can have estimates from which you can make adjustments to meet your proposals. Your budget is expected to meet certain terms of statutes, policies, instructional goals, and collective bargaining agreements which a financial advisor would be better informed about.

For instance, a school budget ordinarily has expenditures distributed to staff salaries and benefits( approximately 80%), operation and maintenance of facility costs (about 13%), materials and supplies costs, e.g., machinery (approximately 6%), and other expenses (approx. 1%). Percentages make it easier to draw a comparison.

Set goals and priorities

After you have an idea of what you are to work with in terms of size of budget and areas of allocating money. You can now set and list goals for carrying out the budgeting planning in your school. A financial advisor suggests ways to make your budget goals specific, measurable, attainable, and realistic after that, you can arrange them in terms of urgency, an expectation of return, and importance to prioritize. Money can then be allocated based on priority.

After identifying the school’s goals and priorities, you can then determine the reasons why the school has not attained them or what the hindrances are. You and your team can brainstorm on ways to overcome these limitations and identify where further changes need to be done to achieve these goals, and will it come at a cost? And by how much? When making suggestions, it is important to ensure it is evidence-based, for example, in a neighboring school or research projects. Do not shy away from extensive research.

Financial advisors will help align the proposed goals to the instructional priorities. Instructional priorities are important to fulfill as they ensure the school continues to receive funding. The advisor can assist you in carrying out evidence-based research on alternative solutions to achieve the instructional priorities. A financial advisor helps you ease the workload associated with prioritization and goal-setting by offering expertise-based creative ideas on achieving goals.

Cost of priorities

Achievement of the set goals will require finances to be realized. To determine the costs to be incurred, you will have to evaluate the resources and expenditures the school is currently operating to answer questions such as what is the school’s financial capability? Financial advisors are equipped with skills to determine these valuations. However, this can be accomplished if you follow the steps discussed below.

Cost analysis: It is done to evaluate the costs of investment in relation to the benefits attained. It is carried out by identifying the benefits of a proposed or existing program, assigning a monetary value to them, calculating the project’s total costs, and comparing the benefits to the costs.

Evaluation of resources: It is defined as inputs that are used to achieve a given objective. In a school setting, they include personnel, equipment, facilities, materials, etc.; you can use the “ingredients” process.

Implementation of plan

Implementation is done through a plan of action. Financial advisors suggest ways to breakdown the plan into manageable events that are in a logical sequence. An implementation plan is important, especially when dealing with costly and long-term investments since it would strain the school’s budget to undertake them all at once; an action plan shows how they can be realized in phases. The advisor can help to monitor and reassess the school’s investment performance and objectives when need be.

Ensure sustainability

Sustainability is the quality of catering needs in the present and the future. Your financial plan should be able to show how the current needs of the school are being met and how today’s expenses help the school in the long term. Financial advisors have the expertise to review and reallocate resources to accommodate changes from time to time which comes in handy when making a budget sustainable.

The two strategies you can adopt to ensure your budget is sustainable are preparing a new budget at the commencement of every year and reviewing the budget midyear to make adjustments.

Prepare new budget, look at the total funds available and work backward, starting with subtracting new projects’ costs. Once you have cleared your list, more likely than not, your expenses will have exceeded the available amount, and this gives you a broader perspective of the school’s financial capability helping you prioritize projects.

Review midyear budget, look out for underused funds and find activities to redirect the money. Such funds could be from vacant positions, operations, servicing, and maintenance activities not required during that period.

Components of a Strategic Financial Plan

Now, what should be included in a financial plan? When developing a school’s strategic financial plan, there are key aspects of the school you should focus on. They can all be categorized as components of the plan.

They include;

The executive summary— outlines the contents being discussed in your plan, highlighting the key points.

Elevator pitch — is a brief and simple description of your school.

School mission— department- the school’s mission and vision show what it offers to its pupils and society in general and where it aspires to be.

SWOT— These are the strength, weaknesses, opportunities, and threats of the current position the school is in, and they are used to show its competitive advantage over other schools.

Goals—represent the measurable quality and quantity of a product or service an organization wishes to offer.

KPIs—stands for Key Performance Indicators; are financial or non-financial metrics used to help your school define and measure its goals.

Targeted audience— includes the needs of the students, guardians, community, and the school’s shareholders.

Industrial analysis—gives niches in the industry in terms of standards, results, etc., and ways your school can fill these shoes.

Operational plans—operational plans describe how the objectives of a strategic plan are to be achieved by giving the processes and activities involved.

Financial projection— gives the results the school expects to gain, for example, an increase in enrolments, performance, etc. Financial models are used to determine these values.

Download Free Templates

Budget preparation can be a lengthy and involving task, especially in cases where you have to always start from scratch. That is why to reduce the workload for you, we have provided downloadable templates which you can personalize to fit your school. Importantly, they are FREE! They contain all the relevant information, so you won’t have to hustle researching what goes where.

Additional Tips for School Budgeting

You want your budget to be effective and make it past approval? Below are some of the guidelines that you can use to improve the quality of your budget.

- Various opinions should be welcomed: When formulating proposals and making budget allocations, disagreements are unavoidable. Differences in opinions should be welcomed as they help in improving the quality of the budget. Diverse inputs create a sense of ownership of the budget to the school’s community and encourage participation during implementation. Remember, some of the weaknesses in your proposals might be unforeseeable, but a different set of eyes can identify and give solutions.

- Be ready to make adjustments: Unprecedented events are likely to occur within the financial year; therefore, the budget should make room for such occasions. This can be allocated by setting a certain percentage, say, one percent of the budget to miscellaneous.

- Use any budget application: You can also use applications and software available to budget for your school. Ensure to choose one that is meant for schools with specifications such as yours.

- As a noob, practice is a must: Should you find yourself you have been tasked to develop a budget for the first time; you must be aware that the only way to get it right is through practice. You can do this by increasing the frequency of budget preparation, for instance, weekly.

- Be assertive once the budget is frozen: After the budget has been prepared to accommodate any differences and solutions raised, execution of the plan should be done confidently. Even when unforeseen events occur, as the leader one should be assertive in how they handle these occurrences. If this is carried on for years and staff is trained accordingly it creates an organizational culture of working towards the realization of the plan.

Frequently Asked Questions

How do you allocate for special education students?

Special education students require various special facilities and equipment; therefore, setting aside some money for these requirements helps accommodate them in the school.

What is the minimum per-pupil funding?

The amount of money allocated for every pupil differs from state to state and country. In the UK it is averaged at 3500 euros while in the US between $12000-20000.

What percentage of the school budget should be spent on staffing?

The percentage spent on staffing ranges from 80-90%, 90 being prevalent in special schools. This leaves enough for other expenses.

Conclusion

A school budget goes a long way in avoiding misuse of funds in a school and helps avoid debts, a situation no organization desires to be. Ensure that you are well planned when drafting a budget. Engage the relevant parties and align them to the school’s long-term goals. The intervals of budgeting for a school are up to the school’s management but not so long intervals are desired to identify shortcomings early and mitigated. You should not shy from giving your honest opinions as well as welcoming opinions from others. Budgeting should be a participatory process from all school personnel, not just leadership. As involving as the budget preparation process is, it is very much doable.

.