In this guide, you will get all the necessary information that is required to create an effective church budget.

Types of Church Budgeting

Budgets are used for planning and control. Planning requires high-level decisions about priorities that align with the strategy, while control ensures that management implements what has been planned and achieves objectives. Budgets are divided into three categories. Which one is best for your church would be determined by the specific needs of your congregation

The different categories are described as follow;

Incremental budgeting

Incremental budgeting, also known as a line item or conventional budgeting, is dependent on spending from the previous year. The majority of churches follow this budgeting process. Incremental budgeting uses last year’s budget as a starting point for the next year’s budget, adjusting each item for expected expense fluctuations or operation shifts.

Zero-based budgeting

The executive branch of the government uses a budgeting mechanism identical to this. Every year, the government cuts all spending to zero, forcing every agency to explain all funding needs for the coming year. In zero-based budgeting, any program begins at zero dollars.

It is a time-consuming and challenging procedure. It is, however, beneficial for churches and nonprofits whose services and methods of service are consistent year after year. Some experts recommend using zero-based budgeting every five years to take a new look at both projects and events.

Program budgeting

System budgeting assesses both projects and services’ feasibility based on their existing funding levels and their ability. The organization recognizes each initiative or operation, the needs it meets, and the success with which it has met those needs in the past.

The next move should be to determine a spending goal for the coming year. It may depend on available funds, donations, previous giving levels and expected progress, assessed needs, or a mixture of these factors.

Components of Church Budget

All financial inflows and outflows must fall into one category, and some will need more attention than others. However, your church’s percentage should allocate to each of these categories in your budget depending on your situation and the church’s budget process.

Composition of any church budget consists of;

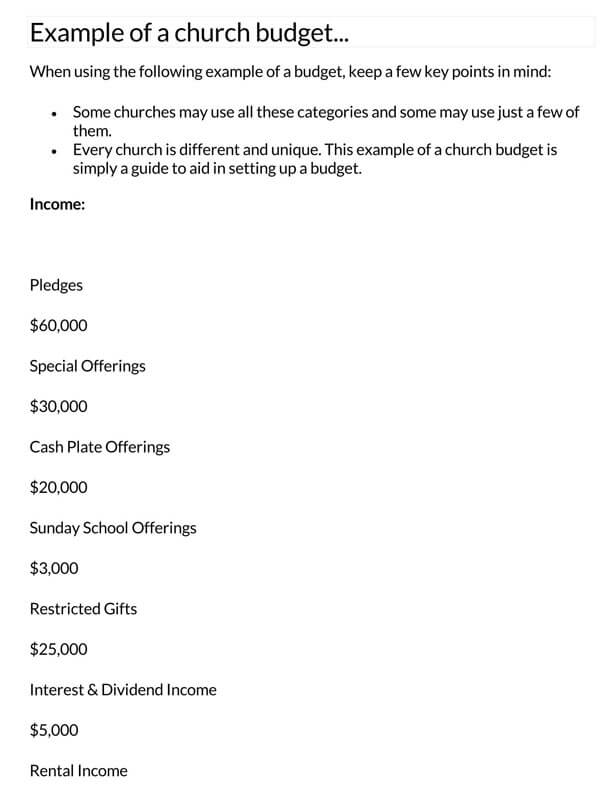

Income

The income category in your church’s budget represents all the financial income that the church receives. Here, you must separate the different sources of income. Funds donated to missions cannot go to a new building. And, the funds given to the mission ministry cannot go to the pastor’s salary.Keep all sources of donations for the purpose for which they were given.

Personnel

The church budget’s personnel category includes all salaries, benefits, and bonuses given to any church employee. And remember that investing in a church management platform is one of the fastest ways to increase the church’s executive team’s quality.

Administration

The category of administration includes everything from the bishop to the church management platform. Budgeting is probably the best and most economical one for managing it.

Facilities and equipment

Facilities and equipment include services such as electricity, water, telephone, insurance, maintenance, and even toilet paper. This category is essential and needs a lot of attention. It is an integral part of how its members and visitors experience a church. The purchase of these materials must be made carefully and registered in the system to enter the final budget.

Outreach

Who doesn’t like a big event, right? Lots of anointing, power, and fellowship. However, churches should be careful when investing in social events. Nobody likes to be invited to dinner in a messy house. So before you dedicate 70% of your church’s budget to a major outreach event, make sure you are ready to make the most of this opportunity to make an impression.

Direct ministries

In the direct ministries category of the church budget, all ministries such as children, youth, counseling, adult, men, and women’s ministries are also included

Church expansion funds

Church expansion category maybe a fund to build a new structure, renovate an existing structure, or add a new system. It will happen as the church expands. As a result, it’s essential to put aside a certain sum of money for this. And if it’s only in case of an emergency.

Debt

The trick to taking your church out of debt and holding it out can set aside money for savings or additional payments on unpaid debts. therefore you must mention the debts so that you can monitor how much savings are utilized.

How to Make a Church Budget

Most priests are not experienced in the budgeting world, and bringing this concept to the church setting can be difficult, and for this, we will guide you through the whole process.

For crafting a church budget follow the steps as;

List sources of income

The foremost step in creating a budget for a church is to write all the sources of the church’s income such as donations, offerings as plate offering and pledge drives, trust funds, dues. facility rentals of church property, bequests, and in some cases investment.

Audit sources and estimate income

When you have all of your revenue flows in front of you, you can start to figure out which ones are made and which ones you can alter. You can still keep track of any salary that is about to expire. Often, pay note as money comes in. If you have specialized programs with higher demand, once-a-year fundraisers, or seasonal revenue, make a plan. After auditing it’s time to estimate income for all ministries and for the year.

Plan your expenditures

For a budget to be successful, the church needs to plan your expenditures like:

Debt: Ensure quality control of debts. Consider whether such a business is a worthy use of church money, which includes debt on the property, building, other miscellaneous.

Ministries: Balance long-term plans with opportunities that arise for the ministry. Assess for which ministry opportunities a church is best equipped to undertake, such as missions, pastoral needs, educational ministries, music, youth, and other miscellaneous.

Staff: Often, investing in a church management platform is quick to improve the executive team’s quality. The expenditures that fall in the staff category include salary, pensions, ministry-related expenses, travel, insurance, housing, and incentives

Savings: The savings of a church mainly includes any unpaid debt the church has advanced, but it can also be in monetary terms. The amount of savings a church has a significant impact on its budget planning determines how much a church can spend without worrying about any unforeseen event.

Facilities: It is a crucial category that requires a lot of effort. It is a vital aspect of how members and tourists see a church. The facilities that fall into this category include utilities, insurance, maintenance, website, office expenses, kitchen expenses, power, sanitation, telecommunications, and even depreciation

Benevolence Fund: The fund is made up entirely of donations, and the costs are the funds allocated under the control of the committee on the benevolence fund. The policy and practice of benevolence were established to shield pastoral personnel from the impact of financial decision-making on benevolence.

The scheme should explicitly involve the person responsible for the distribution and collection of the benevolence fund. Many churches get financial assistance requests, and the sincerity of each request is difficult to evaluate. Church leaders may use policies and procedures to establish guidelines for those who may receive assistance and decide how the benevolence Fund is allocated to help make their decisions a little easier.

Audit the budget

Remember to take into account all reservoirs of revenue when reviewing previous earnings. It may include the donations and offerings: the money given by individuals, fees: the fee charged by the church for different ceremonies, and investments in trust funds. Make a budget audit every month and pay close attention to detail. There are different auditing software solutions that you can use to manage your budget.

Budget processing

The budget review committee or church board sets the overall budget with revenue projections and allocates amounts to individual departments.

Allowing individual department managers to prepare their budget estimates makes them more accountable, accurate, and reliable. This approach’s advantage is that the job manager can better follow his budget because he created it and understands its reasoning instead of a budget is given to him from top to bottom.

It adds a layer of responsibility in which the manager cannot blame anyone but themselves if they do not meet the budget requirements that they have recommended. After these departmental budgets are prepared, they are submitted to the next management level for review and approval.

Top management defines the strategy and goals, and then managers and supervisors estimate the budgetary requirements needed to carry out the strategy. The budget is established and sent back for review and is negotiated back and forth until a final budget is approved.

Importance of a Church Budget

Achieving goals does not happen by accident. A plan, supported by budgetary funds, is needed to complete the strategy. A budget process forces churches to plan and set goals that provide a structured approach for church-wide initiatives. The budget helps facilitate the implementation of the strategic plan by allocating resources to the church’s priorities. It eliminates the struggle for spending

The church budget helps in keeping track of money coming. You must first understand the church’s budget and how it is received before distributing your money. Which months or programs provide the most diverse offerings? What are the driest months of the year?

It appears self-evident that budgeting entails monitoring of funds coming in and heading out. But it’s not that simple. The quality of your budget is just as strong as your financial awareness. The more you keep track of your cash in and out, the easier it will be to create realistic budgets in the future.

A budget will help to allocate money for essential ministries. The difficulties you face managing your household finances are similar to those faced by a larger church. If you eat out too frequently, you’ll quickly run out of money for necessities. A budget ensures that money is set aside for things you might not have thought of otherwise.

The ability to set aside reserves for investments or to make additional payments on unpaid debts is critical to taking your church out of debt and holding it out. The budget helps to think wisely of money. A church budget prevents people from thinking they know where the money goes in the church and encourages them to see how it is spent. Although ministries will almost certainly never stop fighting for discretionary line items, you can put a stop to a lot of it.

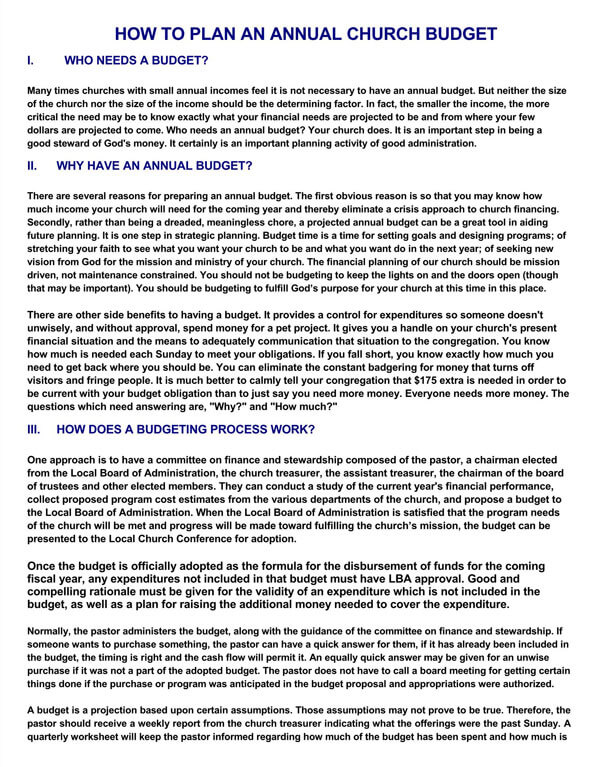

Principles of Annual Church Budgeting

A budget is a ministry action plan and is, therefore, a critical aspect of the church’s overall financial health. What follows are the principles of church budgeting that you must follow to create an adequate church budget.

Expend less than gain

The first and essential principle of annual church budgeting is that your church spending should not be more than the amount of money you have.

Allocate money for annual bills

The majority of payments are paid every month. However, every church has annual expenses, which we must no longer be shocked. Any safe church anticipates these costs and budgets for them by setting aside funds per month to ensure that it is available when the bill comes.

Underestimate your income

We should create a church budget dependent on lower-than-expected earnings. It becomes possible to work under our means due to this, and then one can easily anticipate unforeseen situations.

Overestimate your expending

Churches must do their utmost to expect annual expense fluctuations that they cannot manage. It’s preferable to put money aside for a raise that doesn’t happen than to be hit by one this year.

Consider seasonal fluctuations

Attendance and offers have a daily rise and fall in many, if not all, churches. Set capital aside for high-income months so it will be available during low-income months.

For example, your church will gain more money in winter but less in the summer; account for it in your preparation.

Create emergency funds

Creating an emergency fund is the most common tip that one hears from a financial advisor. If one underestimated his budget and overestimated our outgo, and had a tiny sum of money left over, add it into the emergency fund. Many financial analysts agree that six months’ worth of profits will be optimal in that portfolio.

Current building maintenance

Allowing neglected repairs to accumulate is not a good idea. It will be less valuable in the long term to do an annual cleanout of the plumbing lines than it will be to wait until the toilets leak amid a Sunday morning service. Cleaning, painting, and replacing broken windows are also examples of this.

Budget designing with ministries

It is essential to take advice and guidance from others who are involved in ministry. Through this not only can you have a better understanding of what is needed, but you will also gain more support from ministry members after their questions have been addressed.

For example, don’t think you know what the nursery requires; instead, ask the parents and employees. Then account for it in the budgeting period.

Put finances in how to do ministry

A reasonable budget can be a great servant, but it can’t be an end in itself, so while making a budget for a church, ensure that you don’t let money dictate your ministry decisions.

Compute mobile givings

Nowadays, fewer people are bringing cash or checks to the church each week. Most of them have smartphones that they are comfortable using to make payments and conduct banking transactions. You are losing out if you don’t assist them in being more familiar with smartphone giving.

Set goals

If you don’t have a vision, no motivation or planning in the world can help you succeed. It will be impossible. To maintain a sufficient budget, you need to set goals. Define these objectives and leave them registered in a document.

Cut expenses

Once you have set your goals, it’s easier to cut what doesn’t make sense in the church budget. Just check what costs are lowering your ability to reach your goal and cut those costs.

Remember: If you have a calling, you have goals, and if you have goals, you’ll need to manage your church spendings

Communicate with members

For all this, there must be organization and order in the sector. In this case, it is necessary to have transparency in managing resources to assess management quality. It is only possible that this will be evaluated when you pass enough information to everyone, showing your competence in that area. One way to guarantee this clarity is to be accountable periodically.

Everyone who participates in the budget management of the church must be aware of this. The treasury and the fiscal council must be competent, responsible, discreet, and loyal. In this way, the pastor is not overwhelmed and demonstrates the conduct of serious work. After all, God knows the depths of hearts, but human beings do not.

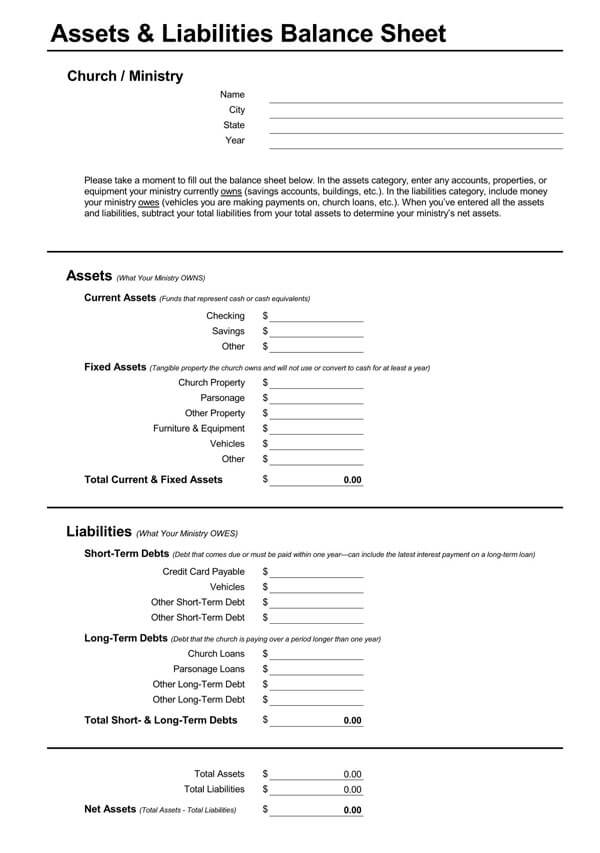

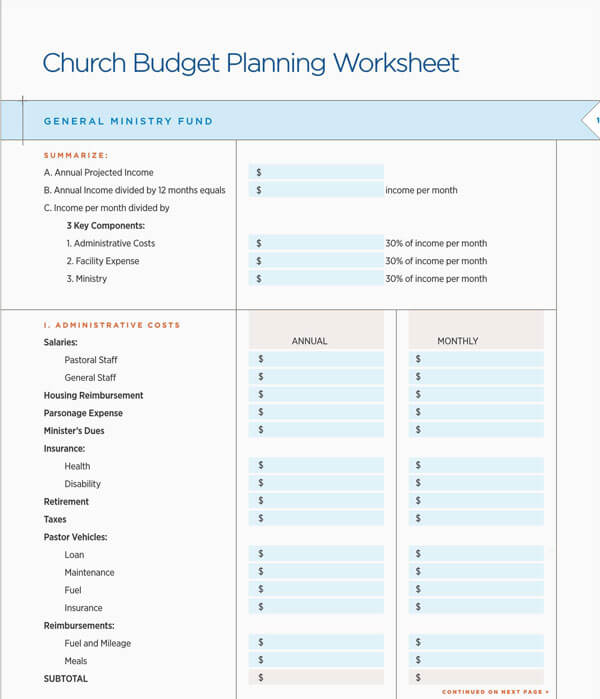

Free Budget Templates

Now that you understand how a church budget is created, what processes are involved, and how to make it productive, we offer free professional church budgeting templates that you can download for free!

Frequently Asked Questions

How much should be in savings of the church?

A church should have up to 6 months’ worth of expenditures in savings.

What % of the budget should be for maintenance?

The 1% of the church’s building price should be allocated as a maintenance budget.

How can we stabilize the budget?

You can stabilize the budget by spending less than your earnings.

Conclusion

Discipline and planning are the cornerstone of a church’s budgeting process and are essential for proper church funds management. Like most things in church administration,