Bank reconciliation is an integral part of accounting procedures. It is one of the procedures used to establish the correct cash balance. Entities usually maintain a cash book to record both bank transactions as well as any cash transactions. The cash column in the cash books usually represents the available cash, while bank columns show the cash at the bank. Similarly, the banks also keep a detailed account for every customer. In the bank books, the deposits are usually recorded on the credit side and the withdrawals on the other side, i.e., debit side. The bank sends the account statements to all its customers every month at regular intervals.

At times, these balances may not match; the entity then is tasked with identifying the discrepancy and reconcile the differences. This is normally done to confirm that each item is accounted for and the resulting balances match. Bank reconciliation helps explain the difference between the balance in the bank’s records and the company’s records. When you reconcile your company’s bank account, you are simply comparing the internal financial records against the records that your bank has provided you. Periodic reconciliation can help spot inefficiencies and identify any unusual transactions caused by fraud or accounting errors.

What is a Bank Reconciliation

Bank reconciliation is the process of harmonizing the balances in an organization accounting records for a cash account to the conforming information on a bank account statement. The process is done by comparing the internal records of transactions and balances to the bank statement – each transaction is verified individually, making sure that the amounts listed match perfectly, and any difference is noted for further investigation.

Importance of Bank Reconciliation

Reviewing your bank account regularly can help you identify issues before it is too late. This is mostly important if you have a business bank account since they receive less protection compared to consumer accounts under federal law.

Periodic review of your bank account can help you in a number of ways, including:

Identify any fraudulent activities in your account before it is too late

When reconciling your bank accounts, it is important that you check for any sign of fraud.

A few things that you should consider are:

- Are there any cheques that were issued without an authorization?

- Does the account have any missing deposits?

- Are there any cheques that you issued that were changed or duplicated, resulting in more money leaving your checking account?

- Is there any unauthorized transfer of cash out of the account, or did anybody make unauthorized cash withdrawals from the account?

Preventing administrative issues

Reconciling your bank account can help you identify key internal administrative issues that need immediate attention. For instance, you may need to re-evaluate how you handle cash flow and your accounts receivable. Or perhaps, you may want to change your record-keeping system and the accounting process that you used.

Purposes & Benefits

There are various reasons why you should conduct a bank reconciliation on your accounts, including:

- To be updated on your bank account balance. By frequently reconciling your bank account, you will always be up to date with your bank account balance. By knowing your bank balance, it will be much easier for you to identify issues on your account.

- To be able to identify problems that you may not be aware of. By reconciling your bank accounts, you will be able to identify issues that you may have otherwise not be aware of, such as any fraudulent activities on your account, unauthorized transactions, and cheques, etc.

- To identify any checks which haven’t been cashed yet. Frequent reconciliation of your bank accounts can help you identify not only cheques that have not been cashed yet but also those that may have been duplicated.

- To be able to carry out internal auditing efficiently. By conducting a bank reconciliation, you may be able to determine whether your organization’s spending is in line with your budget and identify any changes that you need to make to that effect.

Benefits of Bank Reconciliation

There are various benefits to reconciling your bank accounts, including:

Detection of Fraudulent Activities. Monthly bank reconciliation can help you detect any fraudulent activities perpetrated by your employees. Suppose your employee tampers with a cheque to change the endorsed amount; by reconciling your account, you may be able to see the fraud since the bank reconciliation will help you compare the distributed cheque amounts on the company’s books with the cheque details shown on the monthly bank statement.

Avoiding overdraft. By frequently reconciling your checking account, you will be able to know how much money you have available for spending. It is important to note that automatic payments and cheques usually take time to clear and may have not been deducted from your account balance right away. By knowing your balance, you will be able to write cheques that are within the company spending, thereby avoiding overdrafts.

Identifying errors made by the bank. By frequently reconciling your bank, you will be able to identify any errors that have been made by the bank. For instance, you may have deposited some cash into your account, and it may not have reflected into your account, or you may have any other missed transactions – the reconciliation of your bank account will help you identify such issues.

How Do You Reconcile a Bank Statement?

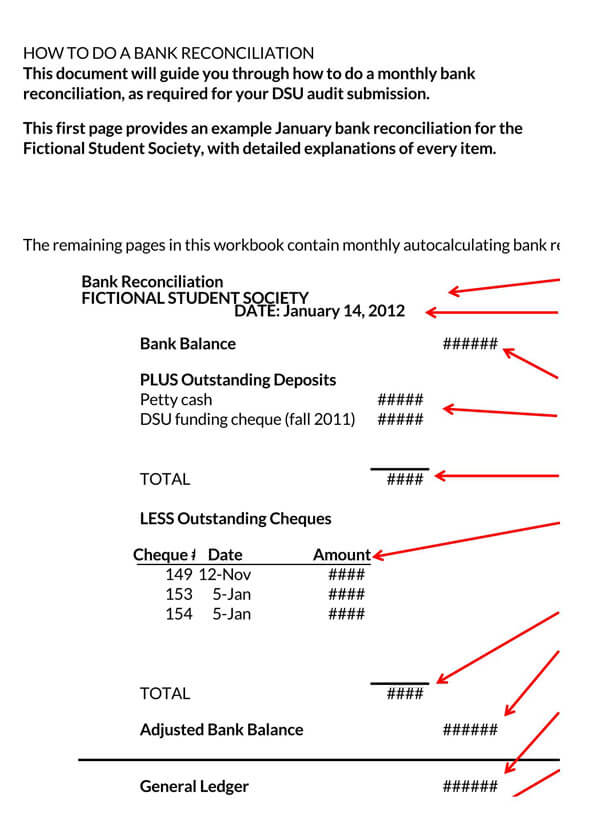

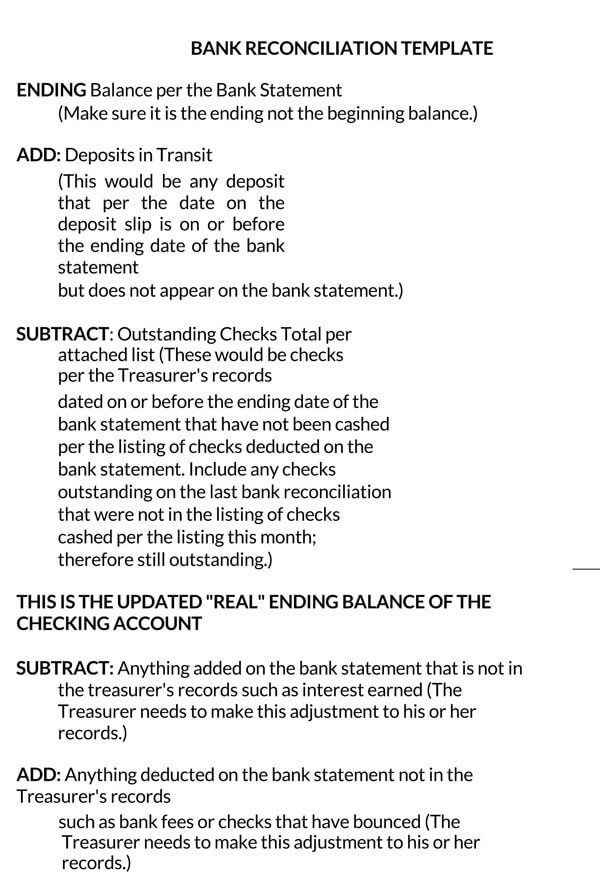

To properly reconcile your ban statement, make sure to follow these four steps:

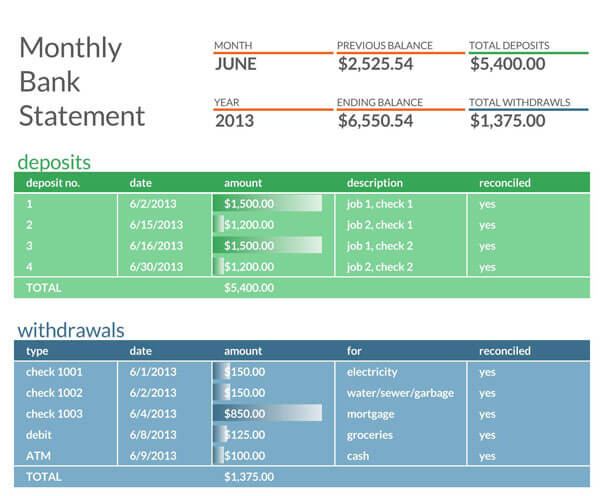

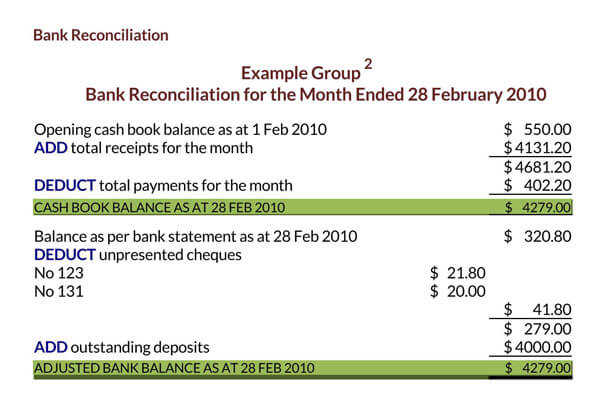

Step 1: Compare the deposits

Go throughall the deposits you made within the month, including all the cheque and cash deposits. Make sure that all the figures included are matching your records. If not, make sure to note any difference in a book and ensure that the bank corrects the error. Ensure that all the items listed in both the bank record and your record are the same.

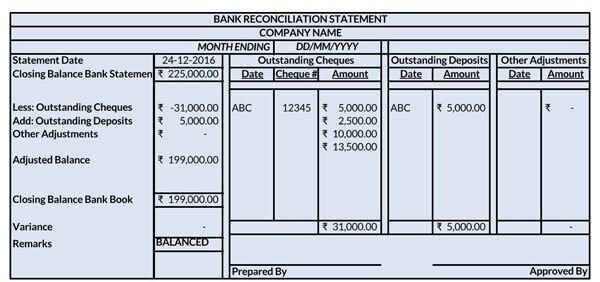

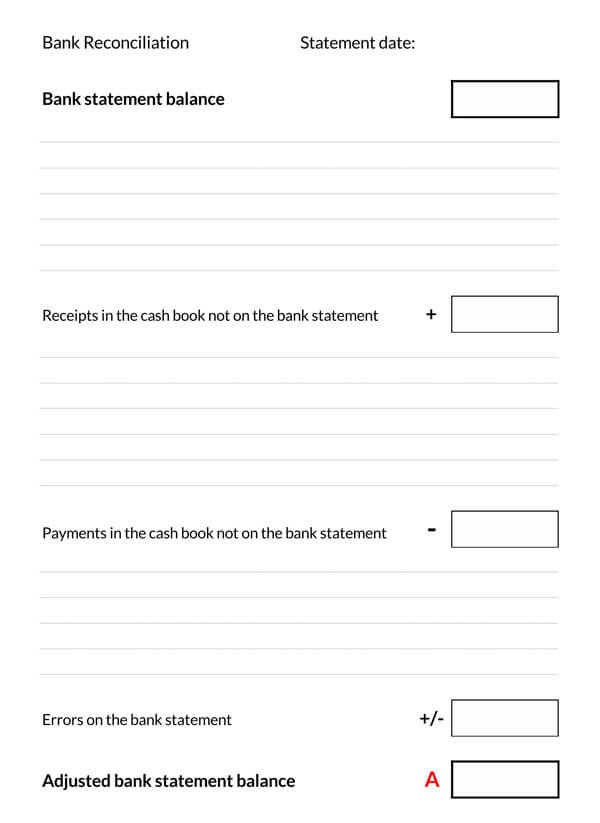

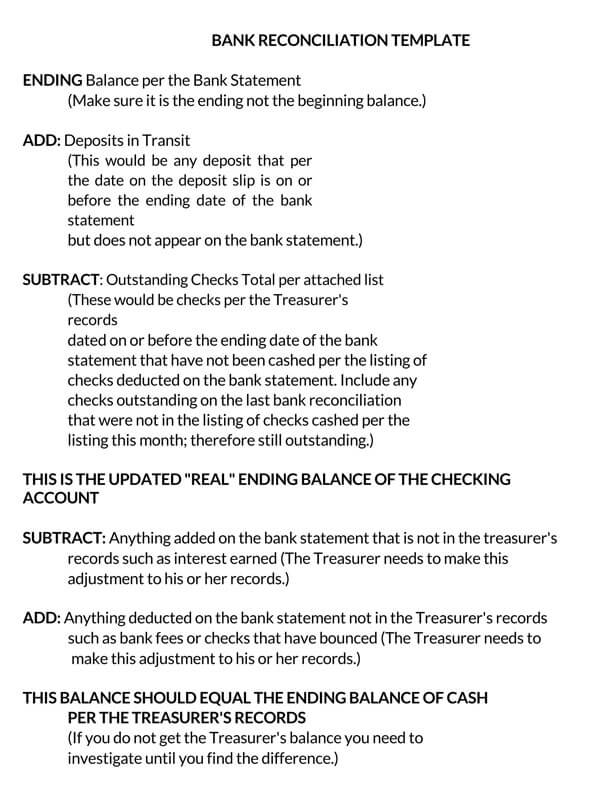

Step 2: Adjust the bank statements

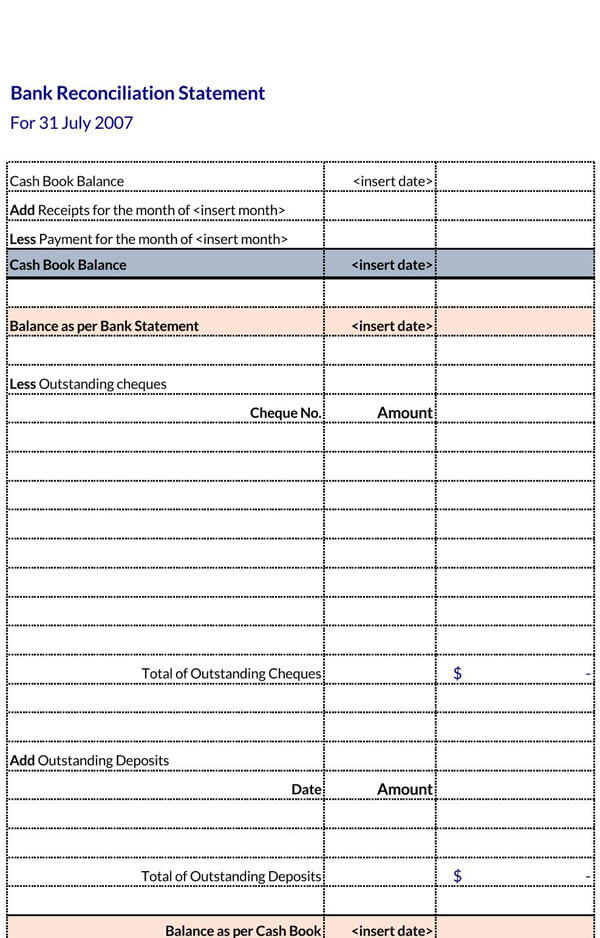

Adjust your balance on the bank statement to the corrected balance. To do this, make sure to add any deposits in transit, deduct any outstanding cheques and add or deduct bank errors.

Bank errors are mistakes that have been made by the bank while creating the bank statement. Common mistakes include incorrect amounts or omission of amounts from the bank statement. Spot these errors and reconcile them to get the right statement.

Deposits in transit are any amounts that you received and recorded in your books but are not yet recorded by your bank. To adjust the bank statement, you must add all the deposits in transit in your statement.

Outstanding cheques are those cheques that you have written and recorded in your cash account but have not been cleared by your bank. Make sure to deduct these amounts from the total bank balance to get the right cash statement.

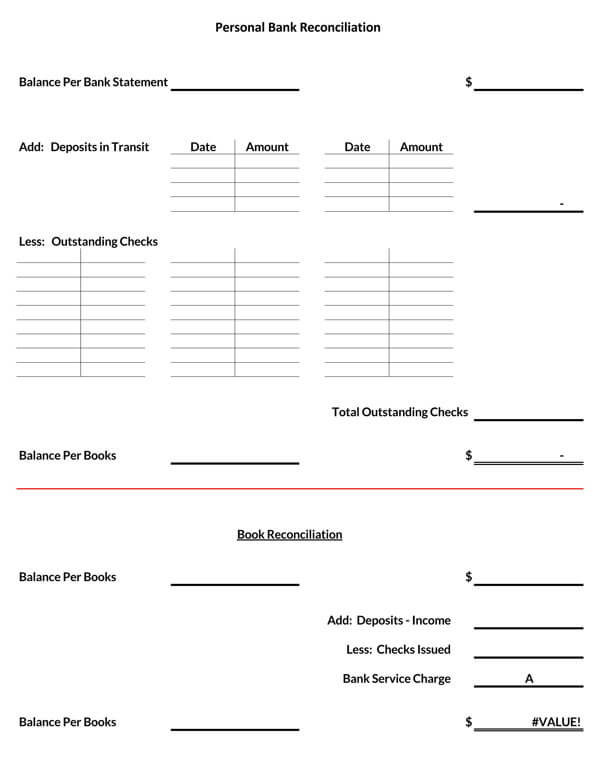

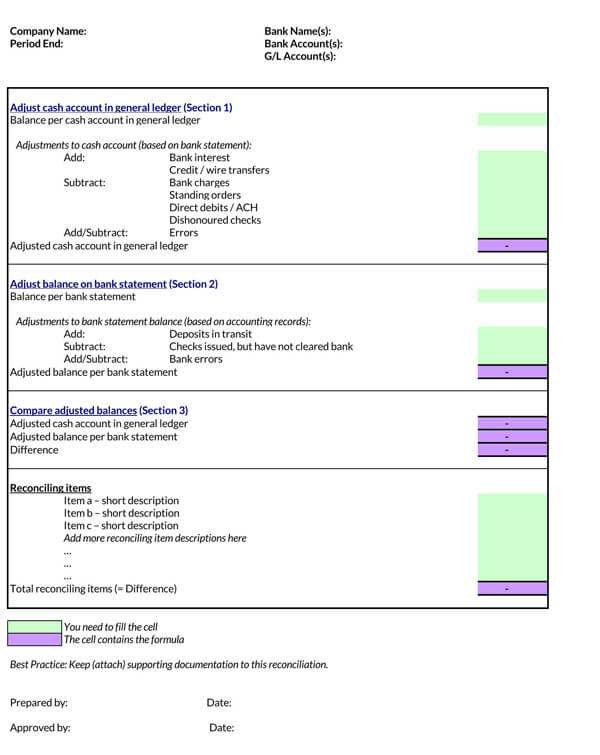

Step 3: Adjust the cash account

After adjusting the bank statement, the next step is to adjust the cash account. Adjust the cash balances in the account by checking the bank for any service fee and any unaccounted-for deposits as well.

In most cases, the bank service fee may not be included in your general ledger balance since they were not charged to your account until the end of the bank statement duration. Make sure to deduct these from your cash account.

Step 4: Compare the balances

Once you’ve made the necessary adjustments, check the end balance. The balance at the end of your reconciliation should match. If they are still not the same, then you will have to repeat the entire process again until they match.

How often Should You Reconcile Bank Account?

For the most part, the frequency in which you reconcile your bank statements will depend on the volume of your transactions.

If you have a business that records several transactions every day, it is recommended that you reconcile your accounts on a daily basis.

For instance, if you are running a busy retail store that runs several transactions in a day, you may consider reconciling them on a daily basis. Consequently, if you are running a small business that only records a few transactions or no new transactions at all-you may consider reconciling your account on a weekly or monthly basis.

Reconciling your account is very important. The more frequent you reconcile your statements, the easier it will be to spot any discrepancies.

Common Problems with Bank Reconciliation

Some of the problems that you may encounter while reconciling your bank account include:

A transaction not being shown

The bank reconciliation list only displays transactions against an individual bank account dated on or before the statement date and has not previously been reconciled. You may find that a transaction has not been captured in your bank statement. You will have to identify such transactions and check whether they had already been reconciled. If not, you will have to include them and make the necessary adjustments to your statement.

A transaction is shown that has already been reconciled

Go through your list carefully and see if there are any transactions that you know of that had already been reconciled before or have been entered twice. If you find any that had already been reconciled, make sure to cancel it and also cancel the unreconciled one.

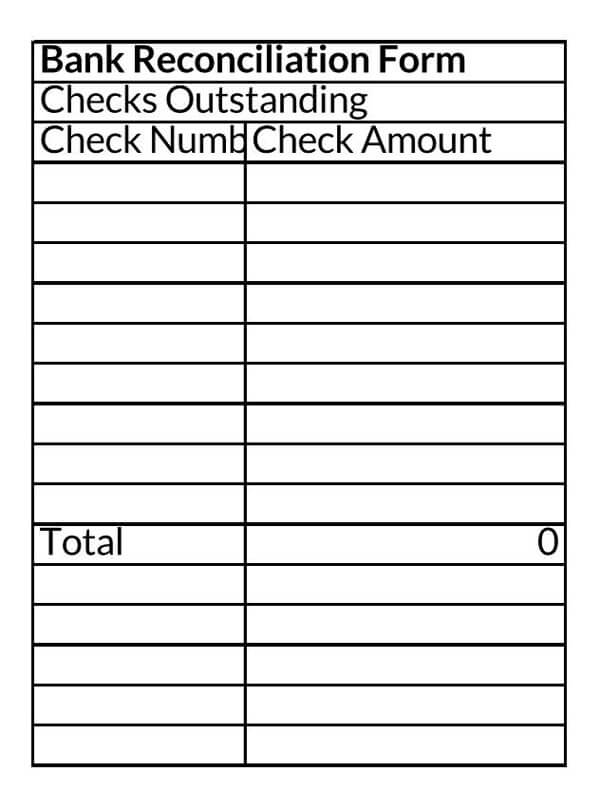

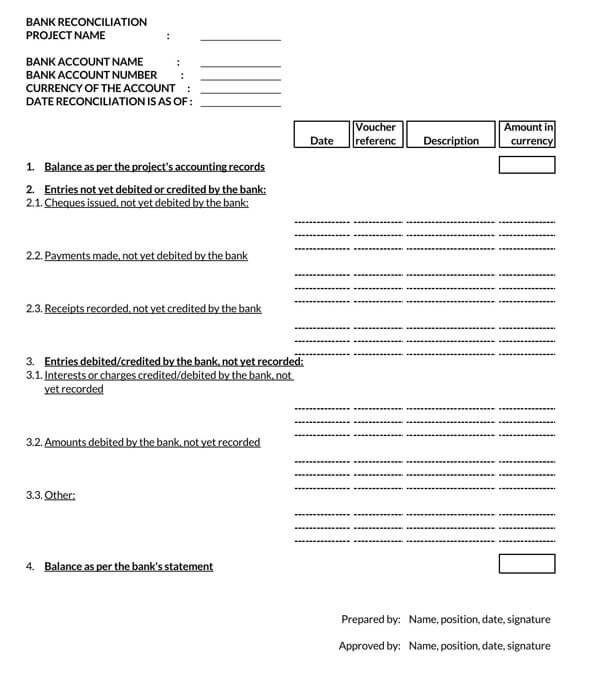

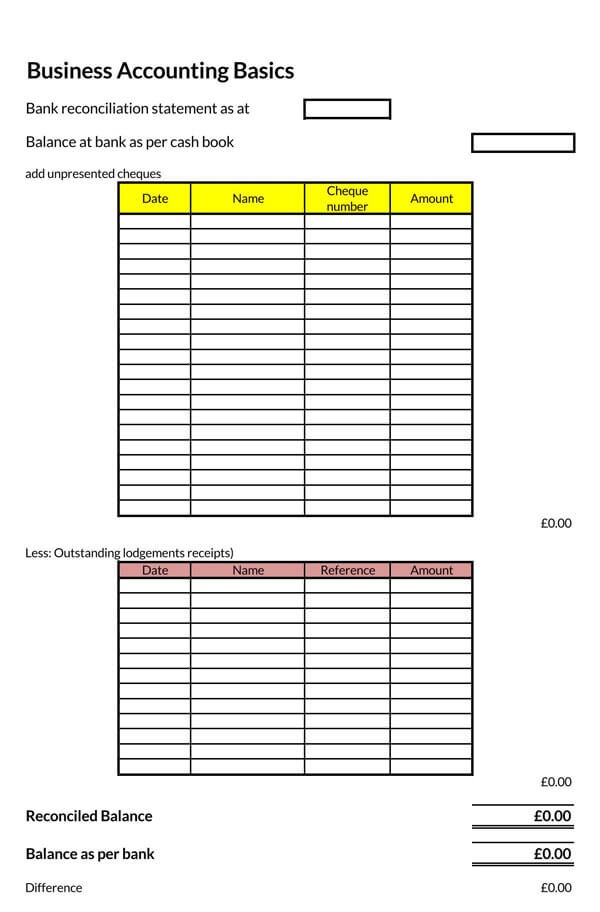

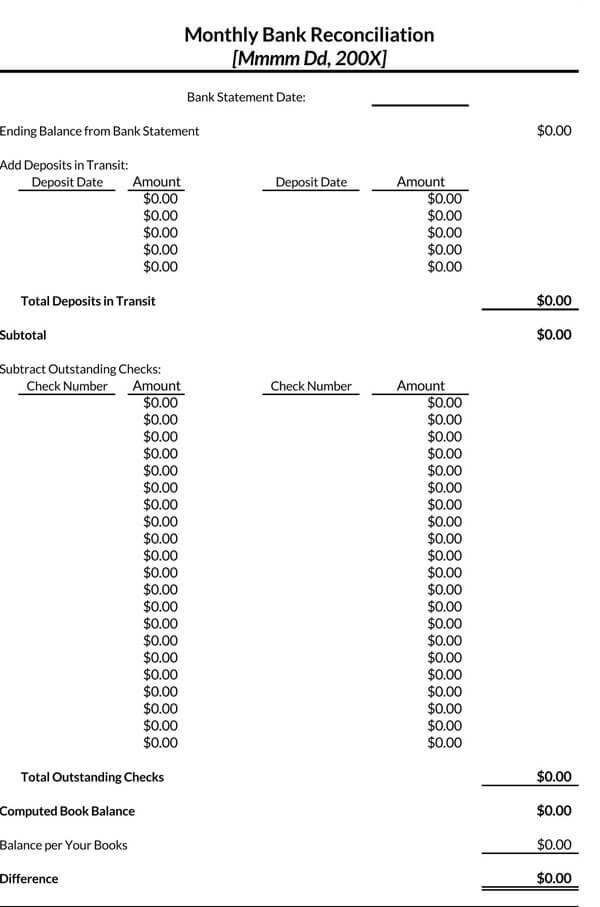

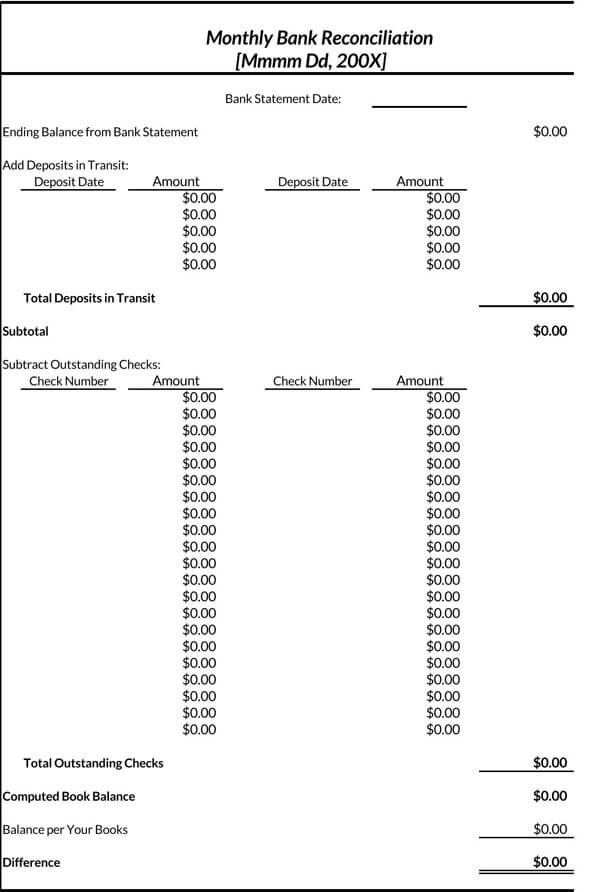

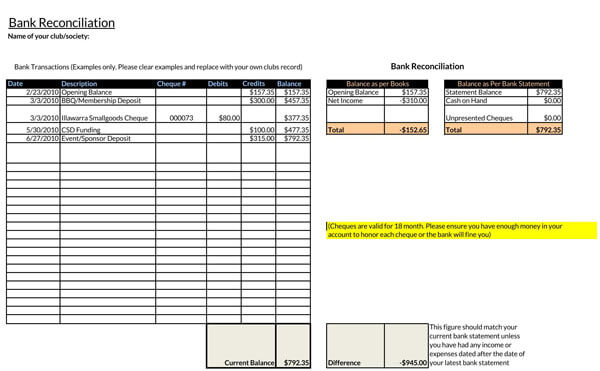

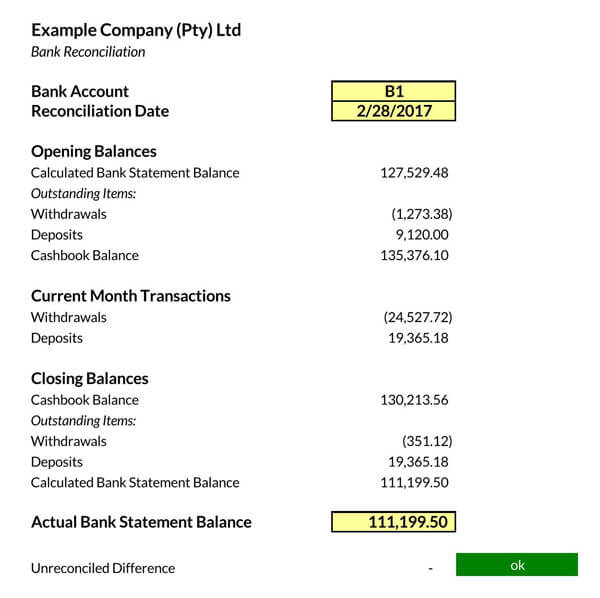

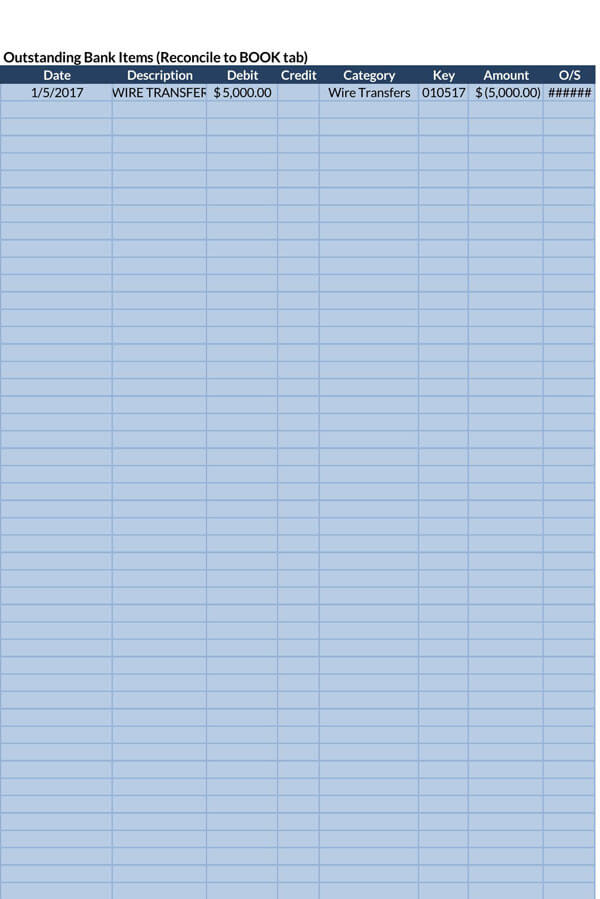

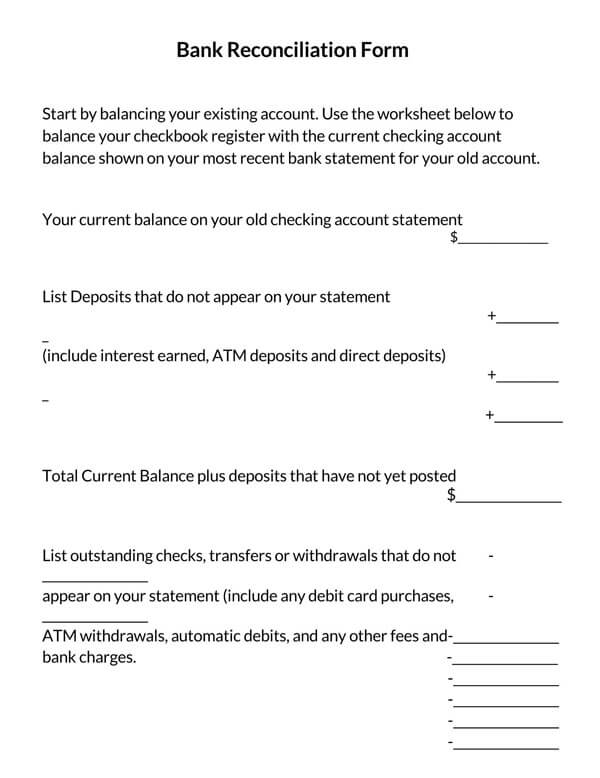

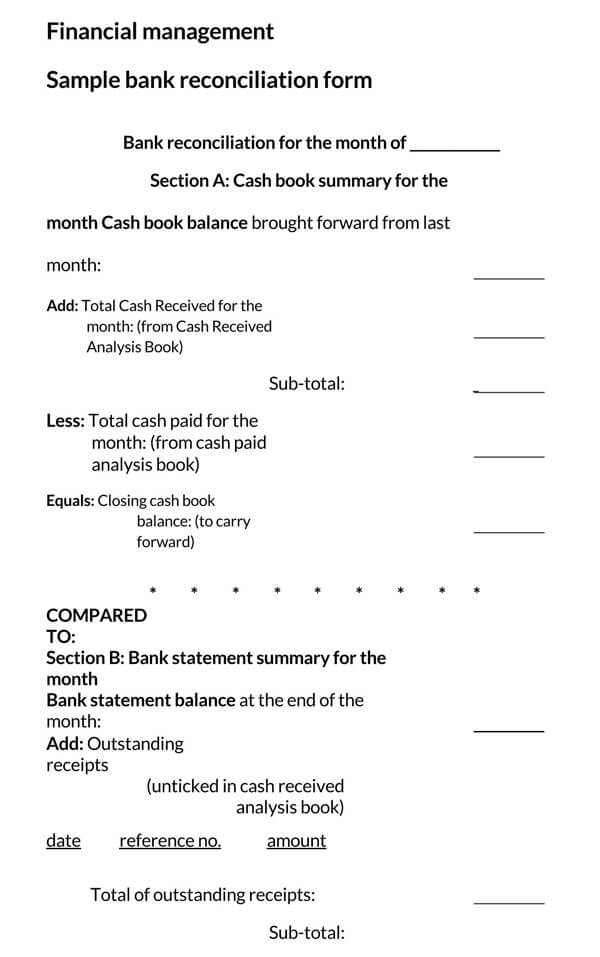

Free Bank Reconciliation Templates

Whether you are an organization or a business, it is important to always keep track of your bank account and capital flow into and out of your accounts. A well-drafted bank reconciliation template can help you in the accounting task by letting you record your cash flows. Download our easy-to-use free bank reconciliation templates to help you not miss out on any important detail when reconciling your statements.

FAQs

Among other key accounting terms and processes that you need to understand, such as tracking business expenses and preparing a budget, perhaps one of the most significant in carrying out the bank reconciliation process for all your active bank accounts. Designed to keep your bank account and general ledger balance in check, the bank reconciliation process helps identify possible errors, correct uncashed cheques, and locating any missing deposits/transactions.